by Will Kessler

Inflation ticked down slightly year-over-year in April but still remained high as rising prices continue to take a toll on average Americans’ finances, according to the latest Bureau of Labor Statistics (BLS) release on Tuesday.

The consumer price index (CPI), a broad measure of the prices of everyday goods, increased 3.4% on an annual basis in April and 0.3% month-over-month, compared to 3.5% in March, according to the BLS. Core CPI, which excludes the volatile categories of energy and food, remained higher, rising 3.6% year-over-year in April, compared to 3.8% in February.

The average for hourly earnings relative to inflation fell 0.2% from March to April and 0.4% when the number of hours worked is considered, according to the BLS. For the year ending in April, real average earnings increased by just 0.5%.

Inflation peaked at 9% under President Joe Biden in June 2022 after rising from just 1.4% year-over-year in January 2021, and has since failed to drop below 3%.

Inflation peaked at 9% under President Joe Biden in June 2022 after rising from just 1.4% year-over-year in January 2021, and has since failed to drop below 3%.

The producer price index (PPI) for final demand, which measures wholesale inflation before it reaches consumers, surged by 0.5% in April, totaling 2.2% year-over-year. An increase in the PPI rate could indicate that more inflationary pressure is working its way down to consumers and that prices will continue to rise.

The Federal Reserve has set its federal funds rate to a range of 5.25% and 5.50% in an attempt to slow the rate of inflation, the highest level in 23 years. A majority of investors do not anticipate a rate cut until the Fed’s September meeting as inflation remains elevated, according to the CME Group’s FedWatch Tool.

August came early to DC today: it's hot and sticky inflation in producer prices w/ PPI up 0.5% M/M for Apr and 2.2% Y/Y – that's the fastest annual increase since Apr '23…

…inflation is NOT dead; it's getting worse: pic.twitter.com/QXsIjmWfNO— E.J. Antoni, Ph.D. (@RealEJAntoni) May 14, 2024

Gross domestic product growth slowed in the first quarter of 2024 to just 1.6%, stoking fears that the economy is in a period of stagflation marked by low economic growth and high inflation.

The labor market slowed in April, adding just 175,000 new jobs in the month compared to 303,000 in the previous month. Research group The Conference Board projects that labor market growth will slow even further in the second half of 2024.

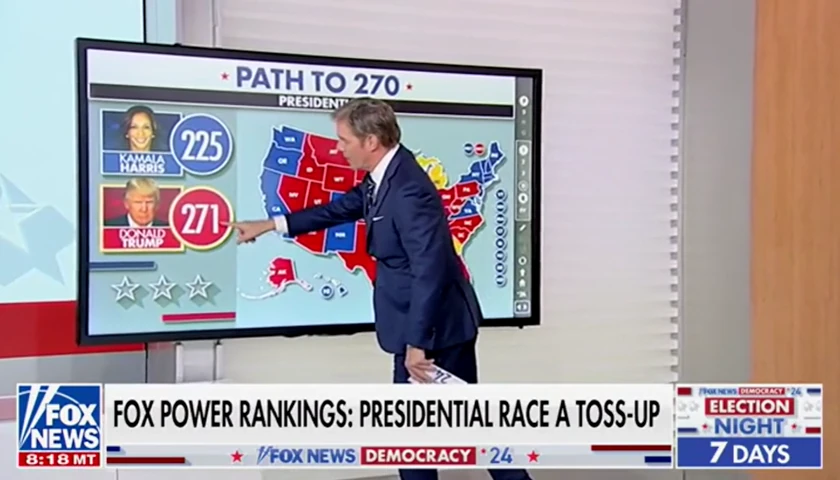

High inflation is increasingly weighing on Biden’s presidential election prospects, with around 49% of voters surveyed by the Financial Times and the University of Michigan’s Ross School of Business saying that the president’s policies have hurt the economy. Around 80% of those surveyed listed inflation as one of their top three biggest financial stressors.

Biden has sought in recent months to blame inflation on companies marking up prices at a time of economic fluctuation in a show of corporate greed. Recent research released by the Federal Reserve Bank of San Francisco disproved this explanation by showing that corporate markups in the recent inflation spike are no different than at other times of economic recovery.

– – –

Will Kessler is a reporter at Daily Caller News Foundation.