by Charlotte Hazard

With inflation, high-interest rates and slowing economic growth already stressing Americans heading into the 2024 election, another reason to worry about the Biden economy has cropped up: distressed banks in danger of failing.

Last month U.S. regulators seized a bank known as Republic First Bancorp and agreed to sell it to Fulton Bank.

The bank reportedly had a total of $6 billion in total assets and $4 billion in total deposits, according to Yahoo Finance. The Federal Deposit Insurance Corp estimated the cost of the failure to its fund would be about $667 million.

Republic Bank has 32 branches in New Jersey, Pennsylvania and New York that are reopening as branches of Fulton Bank by this Monday.

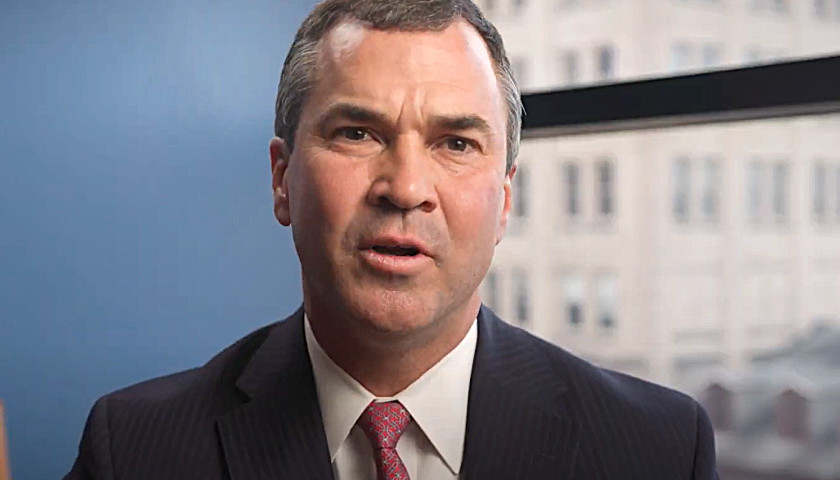

“With this transaction, we are excited to double our presence across the region,” said Fulton Chairman and CEO Curt Myers (pictured above) in a statement.

According to recent reports, hundreds of banks face the potential of failing just like Republic First Bancorp.

Consulting firm Klaros Group analyzed roughly 4,000 U.S. banks and found that the banks face a threat of losses due to “secular changes in social patterns accelerated by the COVID pandemic (such as work-from-home, which has materially impacted demand for office space) and to the impacts of higher interest rates and related inflation.”

“You could see some banks either fail or at least, you know, dip below their minimum capital requirements,” Christopher Wolfe, managing director and head of North American banks at Fitch Ratings told CNBC in an interview.

Federal Reserve Chairman Jerome Powell likewise has warned of more regional bank failures, specifically citing the softening commercial real estate industry.

“This is a problem we’ll be working on for years more, I’m sure. There will be bank failures,” he told the Senate Banking Committee last month.

“It’s not a first-order issue for any of the very large banks. It’s more smaller and medium-sized banks that have these issues. We’re working with them. We’re getting through it. I think it’s manageable, is the word I would use,” he added.

Last week, the Federal Reserve announced it will not cut interest rates until there is “greater confidence” that price increases are slowing down to the 2 percent target, according to The Associated Press.

“Jerome Powell, head of the Federal Reserve, has actually been very vocal about this telling us that expect more bank failures, and when you combine that with all the debt that this country is in…that’s something to be concerned about,” Genesis Gold Group CEO Jonathan Rose said on the “Just the News, No Noise” TV show.

Last year, Silicon Valley Bank collapsed after it couldn’t meet a massive run by depositors who took out tens of billions of dollars in just a matter of hours.

Part of the reason for the significant drop in deposits was the uncertainty over how many and which banks the FDIC provided with unlimited insurance for their depositors.

According to Rose, even more bank failures are expected this year.

“We’ve already been told that there’s going to be more bank failures this year,” he said. “Our trade deficit is out of control.”

– – –

Just the News reporter Charlotte Hazard is a 2022 Liberty University alumni who graduated with a major in journalism and a minor in government. Follow Hazard on X at @CharlotteHazar5.

Photo “Fulton Chairman and CEO Curt Myers” by Fulton Bank.