Georgia Lt. Governor Burt Jones on Tuesday celebrated the passage of legislation he championed to restrict property tax increases and offer property owners a chance to appeal decisions about how much they pay.

Jones said in a statement that HB 581, the Save Our Homes Act, “limits increases in property taxes years to year, reforms the appeals process, and allows for more transparency in our taxation procedures.”

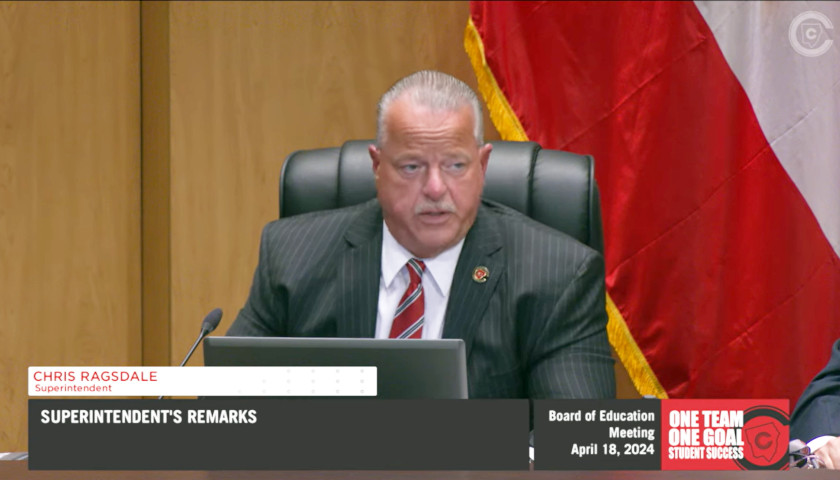

“I was proud to prioritize property tax reform legislation this session,” said Jones (pictured above), adding that HB 581 will allow the state government to “continue to lower costs while eliminating confusion in Georgia’s local property taxation process.”

After the Senate passed its own version of the legislation in February, SB 349, Jones’ office explained in a press release the legislation “creates a mechanism for limiting year-to-year increases in home valuations” to 3 percent each year. It also changes the process to appeal a tax assessor’s valuation.

“Our goal has always been to keep costs low for Georgia families,” Jones said at the time.

He said the legislation “will make the taxation process both less confusing and less expensive for Georgia taxpayers.”

The legislation came after lawmakers began considering legislation in 2023 to help homeowners in response to soaring property values in the Peach State.

Georgia is not the only state to change or cap property tax increases levied on taxpayers, with voters in Texas approving a referendum in 2023 that more than doubled the state’s homestead tax exemption, gave the state legislature authority to limit annual appraisal increases, and created term limits for the governing bodies of appraisal entities.

Colorado voters will similarly decide in November whether to adopt legislation limiting the state’s ability to collect property tax revenue and requiring voter approval if revenues are expected to grow by more than 4 percent in one year.

While proponents of property taxes generally point to the government services they fund, a 2023 study suggested not all states with high property taxes boast efficient services for citizens.

The report noted that Illinois and New Jersey “have the highest property taxes” but nonetheless remain “very near the bottom in the quality of public services.”

States with lower property taxes vary politically, as well. In 2022, Hawaii, Alabama, Nevada, Colorado, and Idaho had the lowest property tax rates.

– – –

Tom Pappert is the lead reporter for The Tennessee Star, and also reports for The Georgia Star News, The Virginia Star, and The Arizona Sun Times. Follow Tom on X/Twitter. Email tips to [email protected].

Photo “Burt Jones” by Kevin W. Earley.