by Steven Richards and John Solomon

As Joe Biden marched toward the presidency in 2020 with a promise to force the wealthy to pay their “fair share” of taxes, his son Hunter was scrambling behind closed doors to clean up a trail of his own delinquent taxes before they became an election scandal, according to once-secret IRS memos made public recently by Congress.

IRS agents would soon discover that the future first son was continuing to allegedly misrepresent his income and deductions to the very accountant he had hired to help, the memos show.

The documents reviewed by Just the News show that Jeffrey Gelfound, an Edward White & Company tax accountant hired by Hunter Biden, was a cooperating witness in the IRS criminal probe of the first son and is likely to be a key witness if the younger Biden is charged with tax crimes by Special Counsel David Weiss.

Gelfound also could become a witness of interest to the House Oversight and Accountability Committee as it digs deeper into the Biden family finances as part of the ongoing impeachment inquiry in Congress.

Buried in the mountain of 700 pages of IRS whistleblower documents released in September by the House Ways and Means Committee are interview reports, affidavits and case summary memos chronicling Hunter Biden’s efforts at the height of the 2020 presidential campaign to remedy his delinquent income taxes dating to 2014 and the income he made from the Ukrainian energy company Burisma Holdings.

Gelfound told agents the efforts in 2020 to pay off Hunter Biden tax debts became a priority because of fears the IRS and other tax authorities would place liens that would become public, a potential embarrassment for the Biden family.

“Yeah, if there was going to be media attention because they were going to lien,” Gelfound told IRS agents in an April 2021 interview when asked whether erasing the tax debts had become prioritized.

In another later interview conducted by IRS agents in November 2021, Gelfound revealed that his firm signed an unusual representation letter with the younger Biden just days after the 2020 election, in which Hunter attested that the information that he provided was truthful. Gelfound told investigators that this was the first time he had ever seen a representation letter like it.

“Yeah, when would you typically sign the representation?” the IRS investigators asked Gelfound. “This is- any type of representation, it’s not standard,” Gelfound answered.

“When we typically prepare returns, there’s an engagement letter that’s different than this one,” Gelfound said, explaining to investigators why this representation letter was different. “[T]his is a first that I’ve seen and had a client sit down and sign a letter of this type,” he said.

You can read that interview transcript here.:

After a review of the provisions of the LLC, he found that Hunter Biden was owed a retainer fee and compensation from the company, meaning that Hunter had falsely classified income as loans. Hudson West III was a joint venture established by Hunter Biden and CEFC associate Gongwen Dong.

Gelfound said Hunter Biden did not push back when he explained what he had found, accepting the accountant’s explanation and agreeing to remedy the mistake. It appears that Hunter Biden was confused about why this income should be classified as income rather than a loan, according to Gelfound.

Biden’s confusion may have stemmed from the fact that his Chinese partners had previously provided him payments in the form of loan on at least two separate occasions, in what Congressional Republicans argue were part of a Biden Family influence peddling scheme.

The accounting firm’s instinct to have Hunter Biden attest to the truthfulness of his information proved prescient. Gelfound later discovered, through his interviews with IRS investigators, that Hunter Biden misrepresented multiple tax deductions at the same time that Gelfound was helping to remedy Biden’s delinquent returns, the memos allege.

Gelfound told investigators he was not aware that multiple payments Hunter Biden claimed as business deductions—including a $30,000 payment to Columbia University for his daughter, a payment to John Hancock for life insurance, and payments for his daughter’s rent—were, in fact, personal expenses, and therefore taxable, the memos show.

You can read the second interview memo here.

You can read Gelfound’s statements on the escort transactions in the interview here.

For example, the representation letter “would have been included as evidence of willfulness and knowledge for the 2018 felony charges, which includes [tax evasion] and [false return] charges,” Ziegler wrote in his affidavit to the committee. Evidence of Hunter Biden’s misclassified payment from Hudson West III would have been used as evidence for similar charges for both the 2014 and 2018 tax years, he added.

You can read whistleblower Ziegler’s affidavit below.

In testimony this summer, the IRS whistleblowers accused the Delaware U.S. Attorney’s office of allowing the statute of limitations to expire on Hunter Biden’s alleged tax crimes from before 2017. The statute of limitations on the tax violations uncovered by the IRS investigation for the 2014 and 2015 tax years expired in November 2022.

Ziegler and his supervisor Gary Shapley, another whistleblower and both Special Agents with long and distiguished careers, each told congressional investigators that the the Delaware U.S. Attorney’s office and the Justice Department delayed their investigation by, among other things, requiring prior approval for interviews, shutting down investigative steps like search warrants for Joe Biden’s Wilmington home, and leaving felonies out of proposed plea agreements.

The years of tax violations for which the statute of limitations expired last year included the bulk of payments from Hunter Biden’s work with the Ukrainian energy company Burisma.

“[Hunter Biden] directed to have a portion of his Burisma income paid back to himself personally as ‘loans’, even though Devon Archer had deducted these payments on the Rosemont Seneca Bohai tax return,” Ziegler wrote in his affidavit to Ways and Means. “[Hunter] had essentially loaned himself his own income from Burisma, failing to report this income from Burisma on his 2014 tax returns and failing to pay the taxes on this income.” In Spring of 2014, a Ukrainian oligarch placed Biden on the Burisma Board of Directors and agreed to pay him $1,000,000 per year.

Hunter Biden’s lawyer Abbe Lowell did not immediately respond to a request for comment from Just the News.

House Republicans have stepped up their inquiry into President Biden and his son Hunter’s business dealings. On Wednesday, Oversight Committee Chairman James Comer, R.-Ky., subpoenaed Hunter and James Biden as well as their business associate Rob Walker. Additionally, his committee sent out interview requests to Sara and Hallie Biden.

On Thursday, he followed up with additional subpoenas for Eric Schwerin—a longtime Hunter Biden business associate—and individuals involved in the sale of Hunter Biden’s artwork at the Bergès Art Gallery.

“The House Oversight Committee has followed the money and built a record of evidence revealing how Joe Biden knew, was involved, and benefited from his family’s influence peddling schemes. Now, the House Oversight Committee is going to bring in members of the Biden family and their associates to question them on this record of evidence,” Comer said.

The White House shot back. “Instead of using the power of Congress to pursue a partisan political smear campaign against the President and his family, extreme House Republicans should do their jobs,” Special Assistant to the President Ian Sams said in a statement.

– – –

Steven Richards joined Just the News in August 2023 after previously working as a Research Analyst for the Government Accountability Institute (GAI) in Tallahassee, Florida. John Solomon is an award-winning investigative journalist, author and digital media entrepreneur who serves as Chief Executive Officer and Editor in Chief of Just the News.

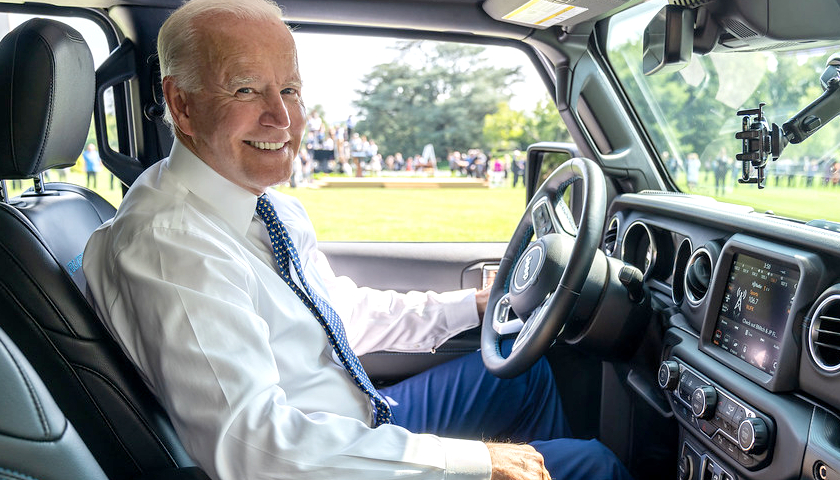

Photo “Hunter Biden” by Ben Stanfield. CC BY-SA 2.0.