by Jason Cohen

BlackRock on Friday reached an agreement to acquire Global Infrastructure Partners for $12.5 billion, a move aimed at advancing the investment giant’s climate objectives and capitalizing on government subsidies, according to statements and reports.

BlackRock is the world’s largest asset manager and is a proponent of environmental, social and corporate governance (ESG) investing. Both companies share a commitment to decarbonization and BlackRock sees the deal’s timing as opportune, as governments have offered businesses rare financial incentives to build infrastructure, including for green energy projects, according to a press release.

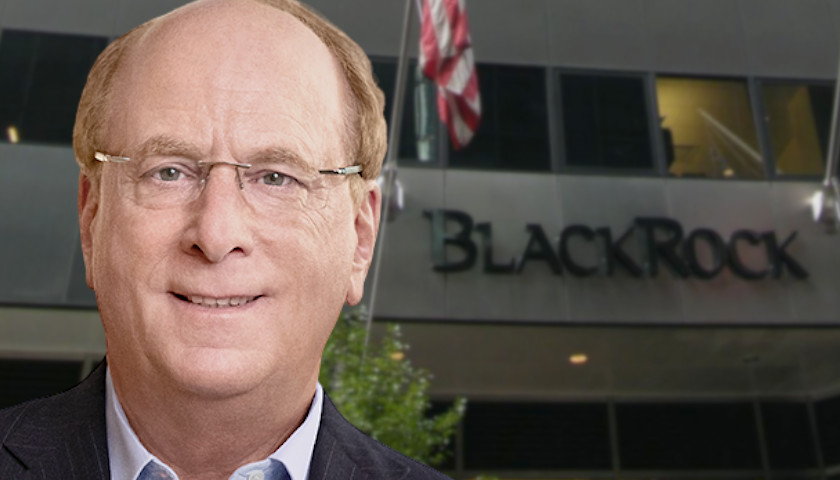

“We believe the next 10 years is going to be a lot about infrastructure,” BlackRock CEO Larry Fink stated during a Friday morning earnings call, according to Yahoo Finance. “If we are going to decarbonize the world… capital and infrastructure is going to be very necessary.”

Rising government deficits are creating a greater demand for private funding in large infrastructure initiatives and subsidies play a role in making these investments more appealing, BlackRock Chief Financial Officer Martin Small stated, according to The Wall Street Journal.

Rising government deficits are creating a greater demand for private funding in large infrastructure initiatives and subsidies play a role in making these investments more appealing, BlackRock Chief Financial Officer Martin Small stated, according to The Wall Street Journal.

Investment funds prioritizing sustainability goals lost $2.7 billion in the third quarter of 2023 and closed faster than they opened during the same period, according to Morningstar. Fink said in June that he will not use the term “ESG” anymore, citing the term’s political connotation, according to Axios.

Fink did not mention ESG during the nearly 90-minute earnings call, according to Yahoo Finance. The deal will likely close in the third quarter of 2024, according to the press release.

“Infrastructure is one of the most exciting long-term investment opportunities, as a number of structural shifts re-shape the global economy,” Fink stated. “We believe the expansion of both physical and digital infrastructure will continue to accelerate, as governments prioritize self-sufficiency and security through increased domestic industrial capacity, energy independence, and onshoring or near-shoring of critical sectors. Policymakers are only just beginning to implement once-in-a-generation financial incentives for new infrastructure technologies and projects.”

BlackRock and Global Infrastructure Partners did not immediately respond to the Daily Caller News Foundation’s request for comment.

– – –

Jason Cohen is a reporter at Daily Caller News Foundation.

Photo “Larry Fink” by BlackRock. Background Photo “BlackRock Headquarters” by Americasroof. CC BY-SA 3.0.