by David Beasley

As more electric vehicles hit the highways, states are worried about fuel tax collections headed in the opposite direction.

States, including Florida, are considering or have been already enacted, annual registration fees to ensure owners of electrics pay a fair share of the cost of maintaining the roads, highways and bridges, said Doug Shinkle, who oversees the transportation program for the National Conference of State Legislatures.

“There are 35 states have electric vehicle registration fees,” Shinkle told The Center Square.

The fees range from $50 a year in Hawaii to more than $200 in other states, Shinkle said.

A bill to impose an EV registration tax in Florida failed last legislative session but will be up again in 2024.

Senate Bill 28 introduced by State Sen. Ed Hooper, R-Clearwater, would impose a $200 annual registration on electric vehicles increasing to $250 by 2029. It would charge a $50 annual fee for plug-in hybrids that use both gasoline and electric.

The proposed legislation was introduced in September and was referred to the transportation and appropriations committees.

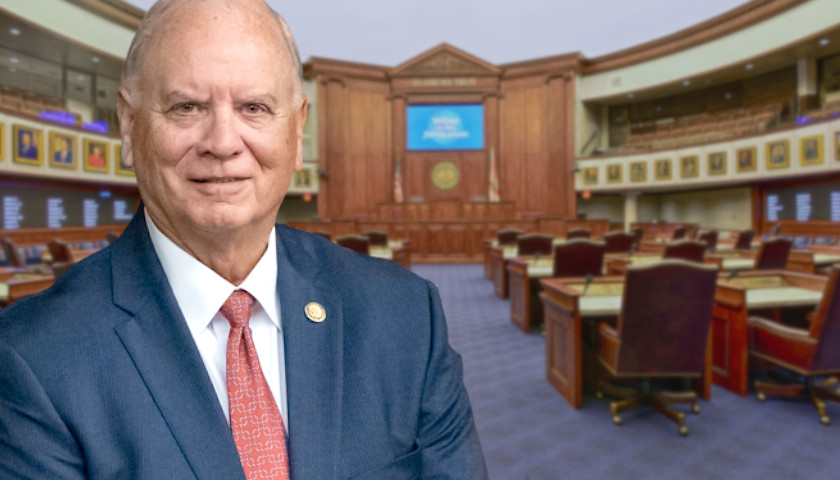

A similar bill by Hooper (pictured above), SB1070, passed the Senate last session but did not clear the House of Representatives.

“The free ride needs to come to a stop,” Hooper told the Senate last year, WFLA reported.

The fairness factor is often cited by advocates of electric vehicle registration fees, Shinkle said.

“EVs are using the roadway system, and they’re not paying the user fee that is the biggest bucket for states so to be fair, there has to be another method for the EV owners to pay into the system,” he said.

An analysis by the Florida Senate estimated the bill would generate $37.1 million annually for the state and $20.9 million annually for local governments.

The Florida Department of Transportation has estimated the increase in EV sales could reduce fuel tax revenues by as little as 5.6% and as much as 20% by 2040.

“States are already seeing a degradation of their fuel-tax revenue” from electric vehicles, Shinkle said. “At the end of the day, the fuel tax is the biggest user-fee bucket. Most states are seeing a decline in their gas-tax revenue not only because of electric vehicles but because all vehicles are much more efficient than they were five or 10 years ago.”

The downside of electric vehicle registration fees is that it is a flat annual fee and not based on miles traveled like the fuel tax, said Shinkle.

“You can have an EV owner who only drives 3,000 miles a year and another who drives 20,000 a year,” said Shinkle. “Is it really fair to make someone who isn’t driving much subsidize other people?”

However, for states, a registration fee is simple and easy to administer, Shinkle added.

States are beginning to explore how to charge electric vehicle owners based on actual miles driven, said Shinkle. The question then becomes how to track miles.

“Sixteen states have annual vehicle inspections,” said Shinkle. “If you are in one of those states, you could conceivably just have your odometer read during the inspection and pay that charge.”

There are other options including devices that could be plugged into the vehicle, he said.

“The technology certainly exists,” Shinkle said. “But it’s trickier to figure out and get all the systems in place.”

– – –

David Beasley is a contributor to The Center Square.

Photo “Ed Hooper” by Ed Hooper.