by Morgan Sweeney

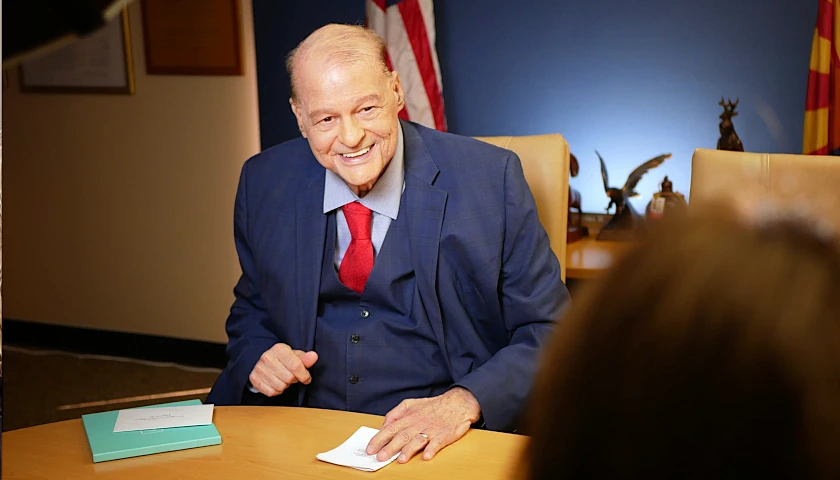

Virginia Attorney General Jason Miyares (pictured above) is the latest to join a coalition of attorneys general “demanding answers” from global investment firm BlackRock Inc., questioning its ability to manage funds passively.

Since August 2022, three groups of attorneys general representing 24 states have banded together in actions challenging company practices at BlackRock – the largest asset manager in the world and the first to reach $10 trillion in assets – claiming that it has allowed political persuasions to interfere with the investment of its clients’ funds.

Last August, 19 Republican attorneys general asked the Securities and Exchange Commission to investigate BlackRock’s relationship with China and assess whether the company used its influence to persuade advisees and investees into embracing its espoused environmental, social and governance values, otherwise called “ESG.”

They also expressed concerns that the company’s behavior didn’t align with antitrust law.

In May, 17 Republican attorneys general filed a motion with the Federal Energy Regulatory Commission, accusing the money manager of violating the Federal Power Act and the BlackRock 2022 Order.

The motion cites that the FPA prohibits “public utility holding companies” from purchasing more than $10 million in voting securities in another “utility;” if a company wishes to do so, it must remain a “passive” and “non-controlling investor” – which, the motion claims, BlackRock is not.

This latest action, led by Montana Attorney General Austin Knudsen, involves 15 attorneys general – all Republicans – with Virginia and New Hampshire being the newest states to join efforts. It’s a letter to “BlackRock-linked mutual fund directors,” which echoes the prior accusations of personal and political entanglement with professional matters.

“The overlapping web of personal and business relationships between major mutual fund directors and BlackRock raise red flags about potential conflicts of interest, and call even further into question the misguided investment strategies done in the name of ESG,” Virginia Attorney General Jason Miyares said.

According to a release from Miyares’ office, “six of the nine mutual fund directors [in question] have a relationship with BlackRock as either a BlackRock employee or a board member of a company where BlackRock owns more than 5%.” Such conflicts of interest violate the Investment Company Act of 1940 and “state principles of independence,” according to the latest letter.

Red states have begun divesting from BlackRock.

So far, Florida, Louisiana, Arizona, Texas, Missouri, South Carolina, Arkansas, Utah and West Virginia have all withdrawn their assets — totaling $4.8 billion — from BlackRock, according to Americans for Tax Reform.

– – –

Morgan Sweeney is a staff writer covering Virginia and Maryland for The Center Square. Morgan was an active member of the journalism program as an undergraduate at Hillsdale College and previously freelanced for The Center Square.

Photo “Jason Miyares” by Jason Miyares. Photo “Exterior of BlackRock” by Americasroof. CC BY-SA 3.0.

Defund Blackrock & ALL

Thank you for writing today story to bring out in the open what BlackRock is doing.

Thank you!

Maybe this issue can bring down Black Rock like tax evasion brought down Al Capone. Let’s hope Black Rock is done !!!!l