by Casey Harper

A federal appellate court dealt President Joe Biden a loss Thursday, ruling that Arizona can challenge the administration’s rule prohibiting states from using COVID-19 funds to lower taxes.

Biden rallied support and passed the American Rescue Plan Act in March of last year. That law provided funding for states to fight COVID-19 and rebound from the economic consequences, among other things. However, the law included a “tax mandate” preventing states from lowering taxes if they accepted the federal funds.

As the law was enacted, Treasury Secretary Janet Yellen warned Arizona and 20 other states that the aid package forbids states from using it to reduce state tax burdens. Brnovich sued shortly after.

A lower court had ruled that the state did not have standing to make the challenge, but the appellate court disagreed, especially since the federal government could potentially reclaim the funds handed down by the federal government because of the tax mandate violation.

“Here, Arizona alleged sufficiently concrete and particularized harms to its ability to exercise its sovereign prerogatives, intangible as those prerogatives may be,” the ruling said. “The quasi-contractual funding offer at issue here can be challenged by Arizona at the outset for offering conditions that are unconstitutionally ambiguous or coercive.”

Judge Ronald Gould said in the opinion that states have standing when an allegedly unconstitutional funding offer is made to them and don’t need to first violate a condition to have standing to challenge it.

The court did not rule on the tax mandate, or “offset provision,” which prohibited a state “from using ARPA funds to subsidize a tax cut or otherwise a reduction in state net tax revenue.” That issue has been remanded to the district court but could return to higher courts after an appeal.

“Specifically, Arizona contends that it was coerced into accepting the Offset Provision because of the size of the funds offered under ARPA and the fraught financial situation brought on by the pandemic,” the ruling said.

Arizona Attorney General Mark Brnovich celebrated the decision.

“The 9th Circuit just gave our office a huge victory in our lawsuit against the Biden administration’s unconstitutional tax mandate under the COVID-19 bill,” he wrote on Twitter. “We’re continuing to fight for Arizonans against the unprecedented overreach of the federal government.”

In its most recent budget, Arizona started gradually flattening its progressive income tax down to 2.5%. Effective in 2024, the state will boast the lowest flat income tax in the country of those with a tax on income.

“With rising inflation, skyrocketing gas prices, and continued labor shortages, Arizona small businesses would directly benefit from tax relief,” said Karen Harned, executive director of the National Federation of Independent Business Small Business Legal Center. “Preventing states from cutting taxes, as the provision in the American Rescue Plan tries to do, is bad policy that needs to change. Small businesses across the state are applauding the Ninth Circuit’s ruling allowing Arizona to challenge the constitutionality of this harmful provision.”

The Treasury press office wasn’t immediately available for comment Thursday afternoon.

– – –

Casey Harper is a Senior Reporter for the Washington, D.C. Bureau. He previously worked for The Daily Caller, The Hill, and Sinclair Broadcast Group. A graduate of Hillsdale College, Casey’s work has also appeared in Fox News, Fox Business, and USA Today.

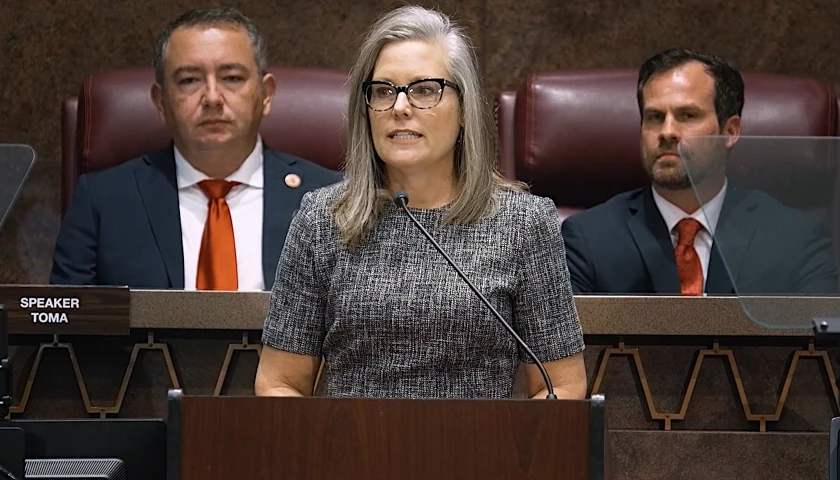

Photo “Mark Brnovich” by Mark Brnovich.