by T.A. DeFeo

More than two dozen Georgia lawmakers want the state’s Department of Labor to stop garnishing the tax refunds of Georgians who are appealing possible Unemployment Insurance benefit overpayments.

More than 30 state legislators sent a letter Friday to Georgia Labor Commissioner Mark Butler, asking the department to stop the garnishments and return the garnished wages until the appeals are resolved.

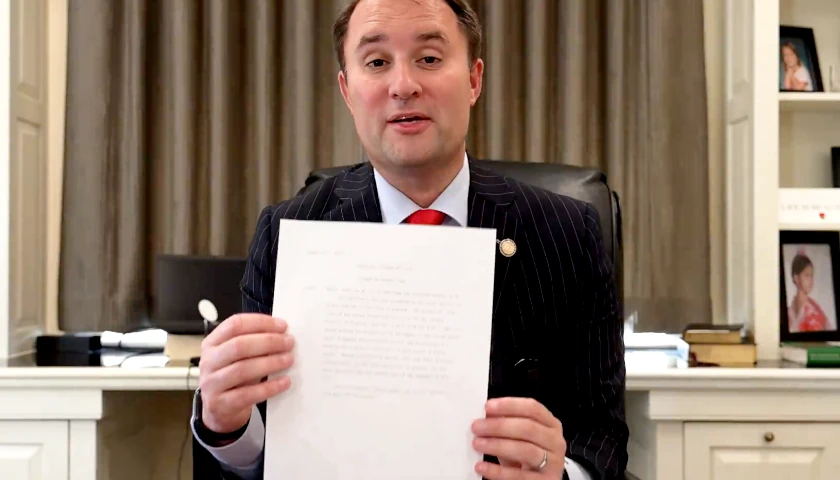

“Every citizen of Georgia is guaranteed ‘due process,’ ” state Rep. Victor Anderson, R-Cornelia, said in a statement.

“Many constituents in my district, as well as neighboring areas, have reached out to me and others regarding their state income tax refunds being garnished, while their properly filed appeals have not been resolved and in some cases even acknowledged by the Georgia Department of Labor,” Anderson said. “My concern is less about whether or not someone was incorrectly paid benefits but more about the automatic presumption of guilt.”

Anderson said the labor department contacted some Georgians last spring to tell them they may not have qualified for unemployment payments the department previously approved and paid amid the COVID-19 pandemic. Additionally, the lawmaker said appeals have not been resolved promptly.

“We are working with this legislator to review the list of individuals he references in his complaint,” the Georgia Department of Labor said in a statement to The Center Square. “There are many situations that can cause an overpayment, including unreported or misreported wages.

“An individual can also initially be allowed benefits, but if his/her employer appeals the decision, the eligibility can be reversed establishing an overpayment,” the department added. “Claimants are presented with options for overpayments, such as requesting a waiver or filing an appeal to the overpayment. We will be working with the individuals sent by Representative Anderson to see if any of these options apply.”

– – –

T.A. DeFeo is a contributor to The Center Square.

Photo “Victor Anderson” by Victor Anderson.