Pennsylvania’s House Appropriations Committee ended hearings on next fiscal year’s budget on Thursday, with the governor’s budget chief defending a plan that many lawmakers fear significantly overspends.

Governor Tom Wolf (D) has asked the Republican-controlled General Assembly to consider the Fiscal Year 2022-23 budget that spends $43.7 billion, an increase of 16.6 percent over current expenditures. His proposal assumes the state will enjoy a revenue intake that surpasses that predicted by the nonpartisan Independent Fiscal Office (IFO) by $762 million.

Republicans in the House of Representatives say that if the governor were to get his full spending wish list and the IFO estimates prove accurate, an $800 million deficit would result. Opponents of Wolf’s proposal have also objected to his predicting virtually no growth in spending for numerous departments in fiscal years following FY 2022-23.

The governor has, for instance, recommended raising correctional institutions’ funding by roughly four percent, to $2.166 billion, in the next budget, yet his subsequent projections would reverse that hike. Wolf also wants to increase funding for the Pennsylvania State Police by 40 percent in next year’s budget but indicated he expects the agency’s spending to stay flat in the four years thereafter.

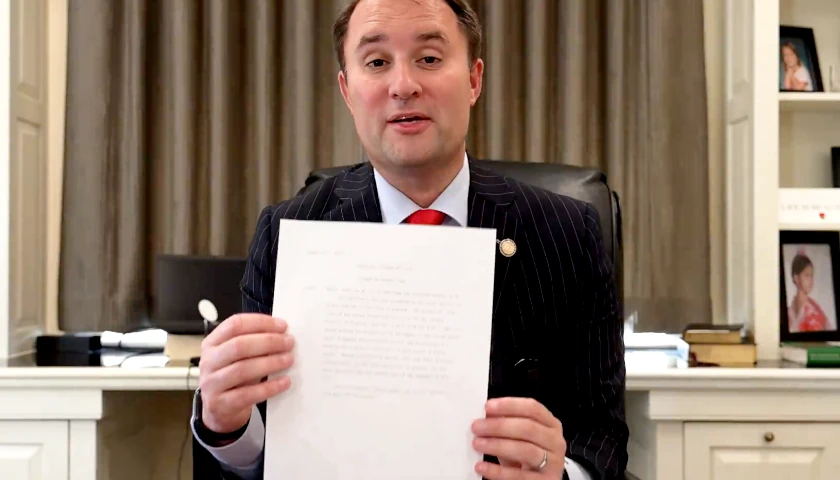

When asked by State Representative Jonathan Fritz (R-Honesdale) if anticipating flat departmental growth in future years bespoke “responsible and honest budgeting,” Pennsylvania Budget Secretary Greg Thall said, “I believe, yes.”

“Interesting,” Fritz responded.

The administration’s critics have said a decision not to project spending increases belies the reality of inflation, which hit a 40-year high of 7.9 percent in February. Adding to the worry is the fact that about $2 billion of Wolf’s budget comes from one-time federal funds allocated by the American Rescue Plan Act (ARPA) which Joe Biden signed last year.

Thall countered by saying that, although many departments are projected as flatlined after the next budget, sufficient money exists across the state’s various funds to sustain the spending that the governor has proposed.

“To say there are not increases is incorrect,” he told the committee. “We shift some general fund expenditures to other funds that are sustainable. We shift some lottery-fund money to support [Medicaid managed care]. I’m happy to talk to you about specific lines or specific things but I feel that this budget is sustainable.”

Ultimately, many House Republicans, some of whom the governor would have to depend upon to get his budget enacted, remained incredulous.

“The governor’s budget magically shows that these departments’ line items will remain flat or even decline in the next four years after the 22-23 fiscal year,” House Appropriations Chairman Stan Saylor (R-Red Lion) said. “Why? We know why – to make the governor’s budget appear to work on paper.”

Tax policy has also been a source of some friction between House Republicans and the executive branch. Wolf has expressed support for reducing the corporate net income tax (CNIT) from 9.99 percent — the second-highest state corporate tax in the U.S. — to 7.99 percent. Republicans have signaled likely support for that (although minor differences persist as to how the corporate-tax base should be broadened). Thall, however, admitted that the CNIT cut would probably be the first idea to get nixed if the governor’s revenue projections proved overoptimistic as the IFO numbers suggest they could be.

Some Republicans and Democrats in the legislature have also suggested a temporary suspension of the state’s gasoline tax in response to skyrocketing fuel prices, yet the governor has not backed such a move. (The cost of regular gasoline rose 62 cents over the last week to $4.40 per gallon, according to AAA Mid-Atlantic.)

And while Wolf has boasted of having proposed a budget that does not include a tax increase — in contrast to prior requests — many say that the state’s participation in the Regional Greenhouse Gas Initiative (RGGI), intended to mitigate global warming, would entail a de facto carbon tax. Pennsylvania’s participation in RGGI is projected to yield the commonwealth $410 million in annual revenue.

“There is a tax in this budget,” Saylor said. “It’s a carbon tax, RGGI, which will create higher electric and heating bills on low- and middle-class families, seniors, handicapped individuals. So while one proposal is to cut taxes, there’s another tax to hurt those who are most vulnerable in this commonwealth.”

– – –

Bradley Vasoli is managing editor of The Pennsylvania Daily Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].

Photo “Gregory Thall” by Office of the Budget.