At a Connecticut General Assembly hearing Thursday, state lawmakers clashed on visions of tax policy, with Republicans pressing for sales tax reduction and Democrats advocating a mix of tax increases and targeted relief.

According to the nonprofit Tax Foundation, 12.8 percent of Connecticut residents’ income goes to government coffers, making the combined state and local tax take the second-highest in the U.S., just behind New York’s 14.1-percent overall burden.

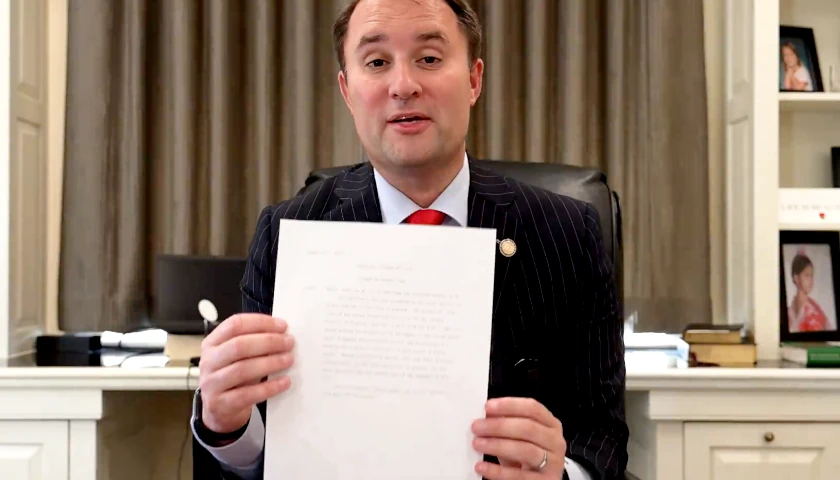

The Constitution State’s sales tax is currently 6.35 percent. Senate Minority Leader Kevin Kelly (R-Stratford) (pictured above, center), Senate GOP Leader Pro Tempore Paul Formica (R-East Lyme) (pictured above, right side), and State Senator Henri Martin (R-Bristol) have proposed lowering that levy to 5.99 percent for the remainder of the calendar year and pausing the one-percent meals tax during that time.

At Thursday’s hearing of the Finance, Revenue and Bonding Committee, Kelly told colleagues that the main impetus for suggesting sales-tax relief has been federal data published in January showing that U.S. consumer prices have risen at a pace not seen in almost four decades. He noted that inflation is not expected to soon abate as the Russia-Ukraine conflict drives up fossil-fuel prices. He further observed that, just between Wednesday and Thursday, the average per-gallon cost of gasoline in Connecticut rose by 10 cents.

The minority leader further declared it would behoove the state, which projects an operating surplus of $1.48 billion, to return some of its heretofore unanticipated gains to taxpayers undergoing financial strain.

“Connecticut residents are struggling to balance their own family budgets,” Kelly said. “Inflation drives up costs on everything from food to energy to home heating oil. The state must not keep a windfall at a time when our residents demand relief and are struggling.”

Democratic legislators, meanwhile, argued for expanding the state’s Earned Income Tax Credit, a move they anticipated would provide $300 yearly to about 185,000 working but low-income households. Advocates for the expansion have yet to secure Governor Ned Lamont’s (D) support for the measure insofar as he has fretted about the upcoming loss of federal COVID-19-relief. The governor has, however, suggested expanding property tax credits and the student-loan tax credit.

Senate Democrats are also urging some tax hikes. Senate President Pro Tempore Martin Looney (D-New Haven) (pictured above, left side) has introduced legislation to impose a statewide residential real-estate tax of two mills (i.e., $2 for every $1,000 of assessed value) on properties with values determined to exceed $1.2 million. Another bill authored by Looney would levy a one-percent surcharge on gains from capital-asset sales by high-income residents.

Testifiers in favor of the increases, including numerous progressive activists and organized labor officials, cited a study Lamont’s Department of Revenue Services released last month contending that Connecticut’s tax system is too regressive.

“The virus has made clear something we have known for a long time,” said Travis Woodward, a state transportation engineer and president of Civil Service Employees Association-Local 2001. “Connecticut’s public services are dangerously short-staffed and underfunded and we have a tax and economic system that not only prioritizes the ultra-wealthy but appears to punish those who work for paychecks.”

– – –

Bradley Vasoli is managing editor of The Connecticut Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].

Photo “Kevin Kelly” by Kevin Kelly. Photo “Paul Formica” by Paul Formica.