by Robert Romano

The U.S. economy added 209,000 jobs in June, according to the latest establishment survey by the Bureau of Labor Statistics, less than expected as 306,000 were added in May, as hiring slowed down nationwide. Meanwhile, the unemployment rate remained about the same at 3.6 percent.

Historically, when hiring slows down by establishments, that usually coincides with economic slowdowns and recessions. In the recent cycle, the 2020 and 2021 recovery from COVID notwithstanding, hiring peaked at about 5.2 percent annualized increase in Feb. 2022. Now, it’s down to 2.5 percent.

That might be worrying to President Joe Biden, who is facing reelection in 2024, but sometimes you just get slowdowns, such as in the mid-1980s and mid-1990s, where afterward you got another bump in hiring before a full-on recession ensued. So, which is it?

Job openings were also down almost 500,000 in May to 9.8 million, a 18.3 percent decrease from its 12 million peak in March 2022, which usually happens during economic slowdowns or recessions.

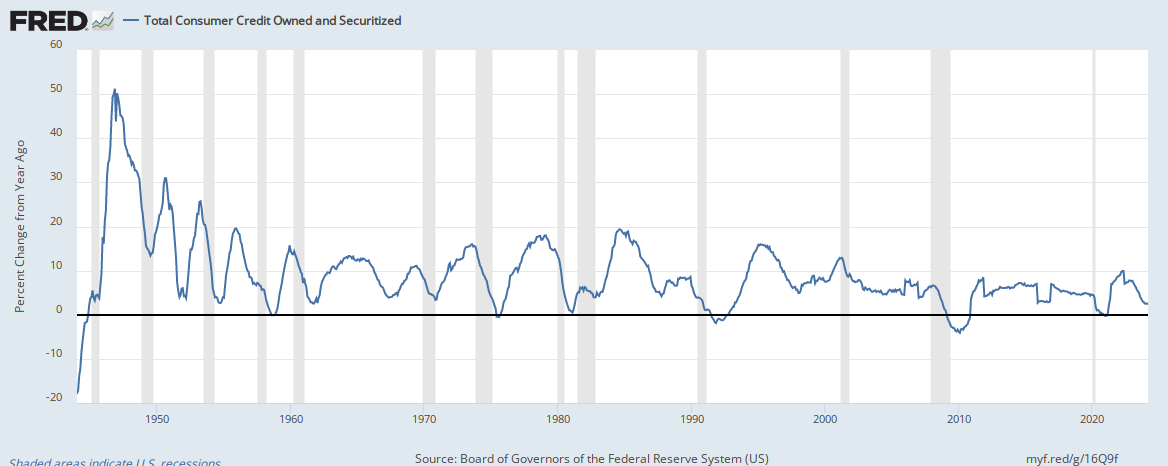

The annual growth of consumer credit appears to have peaked at 8.1 percent in Oct. 2022, flattening slightly to 7.8 percent annualized by Dec. 2022 and now is down to 6.8 percent. This is a sure sign that American households are maxing out their credit after the rampant inflation of 2021 and 2022, and are now slowing down spending to catch up on their bills. The economy overheated and so did household budgets.

The slowdown in credit accumulation has also coincided with the slowdown in inflation, now down to 4 percent in May after peaking at 9.1 percent in June 2022.

But the Federal Reserve is still signaling potential rate hikes on the horizon to deal with any sticky inflation. In June, it held the Federal Funds Rate steady at 5 percent to 5.25 percent, but it also said “additional policy firming” might be necessary: “In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

Usually, the Federal Funds Rate will peak towards the end of the business cycle, and then as a recession ensues, the central bank will begin cutting rates to ease lending conditions and foster full employment. But we’re not there yet, right now, the Fed is still fighting inflation as a part of its dual mandate.

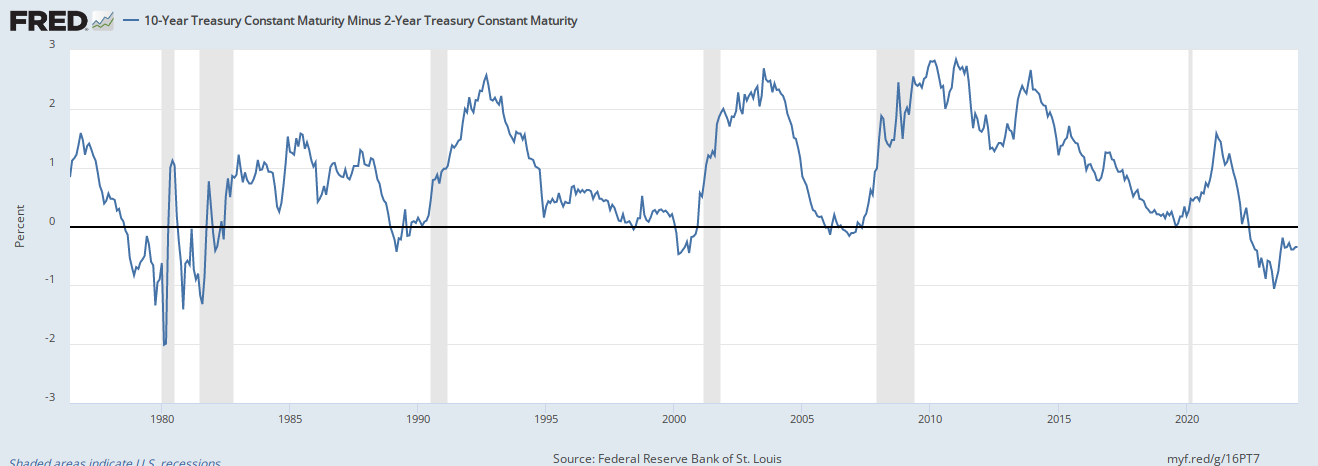

Another key factor to monitor is the spread between 10-year treasuries and 2-year treasuries. Historically, prior to recessions, the curve inverts as the interest rate on short term bonds exceeds that of long term bonds, forecasting slower growth on the horizon.

Right now, the 10-year, 2-year spread is still quite inverted at -0.94 percent. Once it uninverts, that usually comes with Fed easing into the jaws of a recession, and you’ll know that the cycle is ending. When it comes to recessions, the question is not if, but when. Stay tuned. We know President Biden will be.

– – –

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.