by Natalia Mittelstadt

Vice President Kamala Harris’s tax proposal plan is getting significant pushback from Congress members and others as the costs of tax hikes on the American people across the political spectrum are being examined.

Upon a closer look at Harris’s tax proposals, an economist, a New York Times reporter, a small business owner advocate, and members of Congress all voiced their concerns over what the plan entails. Most of them note how the economy will be negatively impacted by her plan and the real-world implications for everyday Americans.

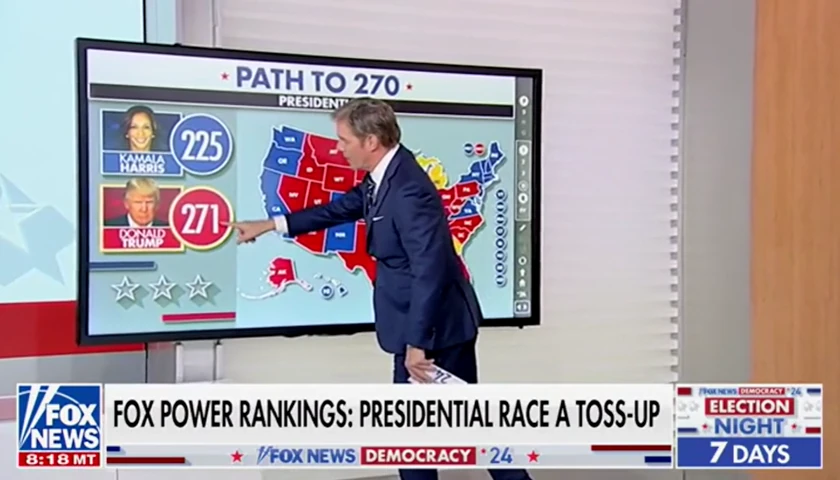

Last week, Harris announced her economic plan of $5 trillion in tax increases, which is what Biden proposed for the federal budget earlier this year.

Harris’s proposals include raising the corporate tax rate from 21% to 28%, nearly doubling the capital gains tax rate to match the personal rate, ending the tax-free transferal of most estates, taxing capital gains on paper before they are realized, and letting the Tax Cuts and Jobs Act of 2017 expire.

Job Creators Network CEO Alfredo Ortiz wrote in an opinion piece for Fox News on Thursday that Harris’s $5 trillion in tax increase is “the biggest in American history. If passed, it would fundamentally reshape the American economy and the scale in which the government extracts funds from citizens.”

He explained that Harris’s proposals “would make American corporations among the highest taxed in the developed world” when including state levies, create “a huge disincentive to invest in America,” and “prevent many small businesses and family farms from passing down their properties.”

“Harris’ tax plans are a giant leap toward socialism, especially when you consider how they’d be expanded to more and more taxpayers once implemented,” Ortiz later added.

Rep. Scott Perry, R-Pa., the former House Freedom Caucus chairman, told the “John Solomon Reports” podcast Thursday regarding Harris’s economic plan, “It’s just unimaginable to me – the federal government is taking in record revenue, yet still can’t pay its bills, right? Still operating at trillions of dollars of deficit every single year, every 100 days, we add another trillion dollars to the debt.

“Meanwhile, the people that I represent, the people all across the country, are struggling to pay their bills,” Perry continued. “They’re paying their grocery bills with their credit card bills. Their credit cards are maxed out. They can’t afford the interest rates for a new home. Young people are being forced to move back in with their parents because they can’t afford their bills. They can’t afford daycare bills. They can’t afford energy bills. Electricity costs are going through the roof because of the policies of the Biden-Harris administration, and that will only increase during the Harris-Walz administration.”

He later added, “This is who the left is. This is who the Democrat Party is. I just don’t understand why people would be willing to vote to give more of their money to the government, to misspend on things that they don’t want, can’t afford, and are wrong-headed for the future of our country.”

Stephen Moore, an economist and Trump adviser, told Fox Business last Friday that Harris’s economic plan is “one of the most anti-business, anti-investment tax proposals that I’ve seen in 40 years.”

On Monday, Moore also told Fox Business on Monday that if Harris’s proposals were implemented, they would lead to “a 30-35% crash in the stock market.”

Rep. Mike Collins, R-Ga., told the “John Solomon Reports” podcast in an episode to be aired on Friday, “When you lower taxes on people, you will gain more revenue in the till from the tax till. It’s just proven – even Ronald Reagan proved that from a tax standpoint. Donald Trump proved that from lowering tax standpoint. But the Democrats don’t understand that. They actually don’t understand much about a general ledger to begin with. The only thing they know to do is spend money, spend money, and spend money. But when you lower taxes, you will actually create more revenue.”

In The New York Times report on Harris’s proposals last Thursday, it mentioned that her plan “may not ultimately be enough to cover the cost of her and other Democrats’ ambitions next year,” as she seeks an increased child tax credit and Senate Majority Leader Chuck Schumer is calling for a significant tax break.

Rep. Harriet Hageman, R-Wyo., told the “John Solomon Reports” podcast in an episode to be aired on Saturday, regarding Harris’s tax proposals, “We didn’t even have trillion-dollar budgets 20 years ago. And now, all of a sudden, we’re talking about a $5 trillion tax increase in addition to what we’re already paying into the coffers.”

“We’re at four and $5 trillion budgets right now, and she wants to have a tax increase double that,” Hageman later added. “It would destroy the economy, it would destroy our industrial base, it would destroy our small businesses, it would destroy our ability to fund our schools. Her tax proposals, her spending proposals, would destroy the economy even worse than it already is in terms of the inflationary pressures we’ve seen. It would destroy our economy almost instantaneously.”

“You cannot put that kind of economic pressure on the American people and expect that they are literally going to turn over 60 and 70 and 80% of their check so that Kamala Harris can do what she would do,” Hageman continued. “Because this woman is not capable of governing. So when I think about what she would do, and her handlers would do, and people around her would do with $5 trillion of additional funds, it absolutely scares me more than I think almost any policy decision I’ve seen. And these people are bad, and they scare me every day.”

– – –

Natalia Mittelstadt is a reporter for Just the News.

Photo “Kamala Harris” by Kamala Harris.