by Bethany Blankley

More Americans are struggling financially as savings are significantly down and debt and delinquencies are up compared to four years ago.

Savings and disposable income are significantly down when comparing federal data under the Trump and Biden-Harris administrations.

As of June 2024, the personal savings rate was 3.4 percent and real disposable personal income per capita was 0.51 percent, according to U.S. Bureau of Economic Analysis data.

In January 2021, the national personal savings rate was nearly 20 percent and real disposable personal income per capita was 14 percent.

Under the Trump administration, significant gains were made from the Obama administration economy he inherited. In January 2016, the national personal savings rate was 6.1 percent and real disposable personal income per capita was 1.5 percent.

Meanwhile, household debt, credit card balances, car loans and delinquencies have climbed under the Biden-Harris administration.

Household debt increased by $109 billion in the second quarter of 2024, to $17.80 trillion; bankruptcy notations added to credit reports in Q2 2024 increased, according to the latest Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit.

Credit card balances increased by $27 billion to a record $1.14 trillion in the second quarter. Auto loan balances increased by $10 billion to reach $1.63 trillion, according to the data.

Delinquency transition rates for credit cards, auto loans, and mortgages increased, with roughly 9.1 percent of credit card balances and 8 percent of auto loan balances being delinquent.

This is after auto loan delinquencies under the Biden-Harris administration reached a near 30-year high last November. “The last time this many drivers were delinquent on their auto loans was when the first mobile flip phone entered the market – in October of 1996,” Bankrate reported, citing high vehicle prices and high interest rates.

High interest rates are driving up monthly payments for used and new vehicles. “The higher the interest rate is, the more expensive your monthly payment will be, which can increase the likelihood of falling delinquent on your loan,” Bankrate says.

By July 2024, car repossessions were up 23 percent and 14 percent higher than in 2019 before COVID-era lockdowns hit, according to a July 2024 Cox Automotive report.

Six months before increasing credit card debt, car loan debt and delinquencies were reported, a New York Fed economic researcher expressed concerns, saying they signaled “increased financial stress, especially among younger and lower-income households,” MarketWatch reported.

“And while delinquencies are rising for all demographics, the researchers said credit-card delinquencies are particularly pronounced among millennials [those born between 1980 and 1994] and among the lowest quartile of households by income, whose debts and basic expenses eat up a larger share of household funds,” MarketWatch reported.

In order to cover basic costs and put food on their table, many families have gone into credit card debt. They’ve also turned to taking out payday loans, draining their savings, or using Buy Now, Pay Later options, an Urban Institute report found.

Among those surveyed, over 33 percent used credit cards to pay for groceries; 3.5 percent used BNPL to pay for them and 37 percent of BNPL users missed their payments, the report found. Nearly 20 percent surveyed paid for groceries with savings “they did not intend to use for routine living expenses,” the Urban Institute said.

Not all credit card debt is the same, the U.S. Government Accountability Office notes.

“Lower credit limits and higher interest rates can make credit more expensive. This means that it’s more expensive for some to use their credit cards,” it states.

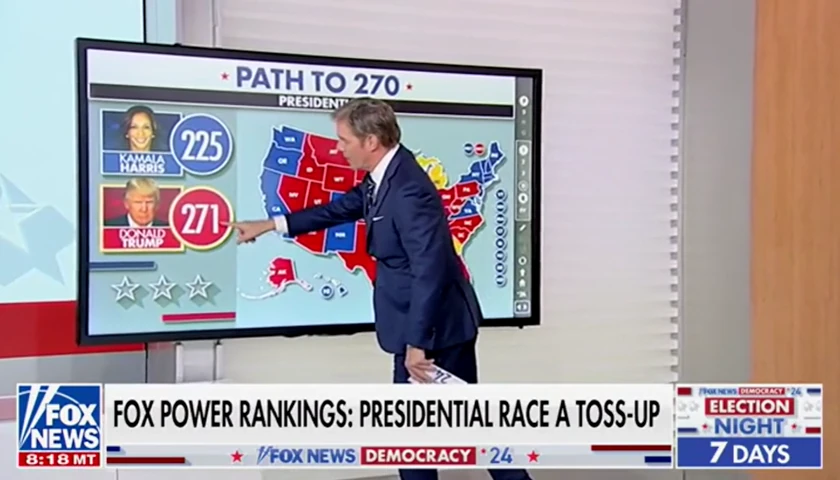

Multiple polls show that inflation, price increases, jobs and the economy remain top concerns among voters.

While President Joe Biden claimed Monday night the country is “moving in the right direction,” most Americans don’t agree: 65 percent of voters say it’s heading in the wrong direction, up from 62 percent in March, The Center Square Voters’ Voice Poll found.

In all recent The Center Square Voters’ Voice Polls conducted with Noble Predictive Insights, inflation and prices increases remain a top concern among voters.

“On the economic front, inflation is still an incredibly painful issue for people,” David Byler of Noble Predictive Insights said.

– – –

Bethany Blankley is a contributor to The Center Square.

Photo “Credit Card” by energepic.com.