by J.D. Davidson

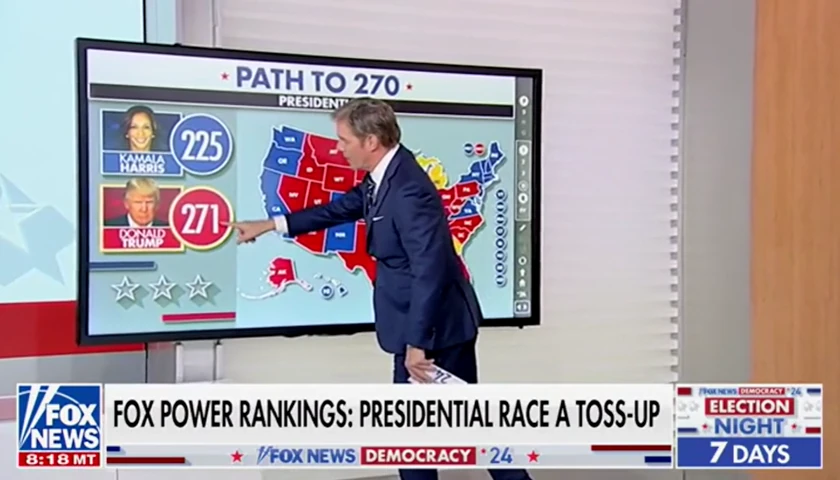

An Ohio lawmaker, federal lawmakers and both presidential candidates want to eliminate taxes on tips, but a nonpartisan tax policy group says the idea could create issues.

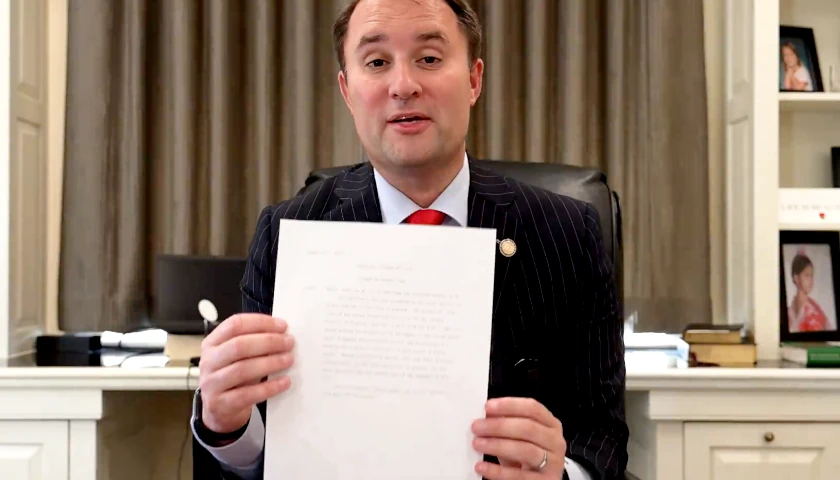

Rep. Jay Edwards (pictured above), R-Nelsonville, recently introduced legislation exempting tips and gratuities from state income tax. It has not been sent to a committee, and lawmakers are not expected to return to session until after the November election.

Edwards’ plan is similar to those pushed by Vice President Kamala Harris and former President Donald Trump in stump speeches on the campaign trail.

It also aligns with legislation introduced in both the U.S. Senate and House. None of those bills have received a vote in either chamber or a committee.

Tax Foundation Senior Policy Analyst Alex Muresianu thinks removing income taxes from tips earned could create problems.

“Both the former president and the idea’s congressional advocates argue it will lower costs for working-class Americans,” Muresianu recently wrote. “But it’s a poorly targeted change, with the potential for unintended consequences for both consumers and the federal budget.”

Muresianu pointed out that only 2.5 percent of the nation’s workforce work in tipped jobs and 5 percent of workers in the bottom 25 percent of earners are in those positions, according to an analysis from Ernie Tedeschi at the Yale Budget Lab.

According to Muresianu, the first issue is that if tips become nontaxable and wages remain taxable, more employees and businesses might move from a split wage-tip compensation plan or a full-wage plan to only tips.

“That would mean more service industries adopting the restaurant industry approach of a list price up front and an expected voluntary tip at the end of the transaction,” he said. “This kind of behavioral response makes it difficult to estimate the cost of the no-tax-on-tips proposal.”

He estimates it could cost in the neighborhood of $107 billion over 10 years.

The second problem could come when traditionally non-tipped service jobs make tipping part of the equation.

“One could imagine a scenario in which, say, highly compensated lawyers or accountants begin to receive some of their income as voluntary tips,” Muresianu wrote.

– – –

An Ohio native, J.D. Davidson is a veteran journalist with more than 30 years of experience in newspapers in Ohio, Georgia, Alabama and Texas. He has served as a reporter, editor, managing editor and publisher. Davidson is a regional editor for The Center Square.

Photo “Rep. Jay Edwards” by Jay Edwards State Rep. Background Photo “Service Industry Worker” by Andrea Piacquadio.