by Hank Long

A former attorney for the Securities and Exchange Commission who conducts independent investigations on pension funds is blowing the whistle on behalf of a group of Minnesota teachers who have hired him to investigate claims that their retirement investment returns have been inflated.

Edward Siedle is well known across the nation in circles that closely scrutinize pension fund investments. He’s alleging that the state’s Teachers Retirement Association recently sent emails to its board and staff and to liaisons in the administration of Gov. Tim Walz warning them of Siedle’s investigation.

Siedle obtained those emails through data requests, he wrote in a July 31 article he published on his “Pension Warriors” Substack website, entitled, “Walz warned of ‘many serious risks’ facing state pensions under his watch.”

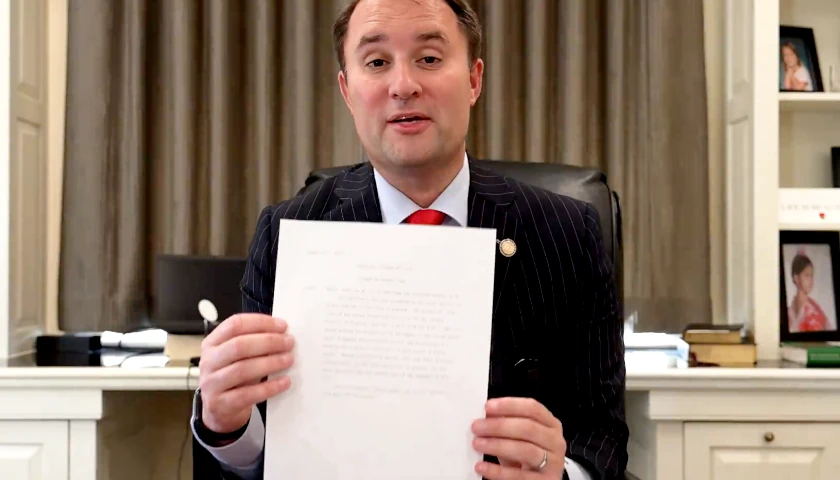

One of the emails Siedle says he obtained through the data request revealed that Minnesota Teachers Retirement Association executive director J. Michael Stoffel had written to trustees of its board and staff in March to warn them of Siedle’s intent to conduct a forensic investigation of its investments:

“In researching Mr. Siedle the reports he has issued on other pension plans are focused on the investments of the plan. As TRA does not manage its investments, Mr. Siedle’s inquiries likely will be focused on (State Board of Investment). SBI invests assets for not just TRA, but the Minnesota State Retirement System (MSRS), the Public Employees Retirement Association (PERA), volunteer fire relief plans, state cash accounts of over 400 state agencies, and the non-retirement program that provides investment options to state trust funds and various public sector entities. Therefore, all of those groups, entities, and entities’ boards will be impacted by this movement.”

The State Board of Investment oversees the state’s various pension plans for public employees. It’s led by the state’s statewide constitutional officers, including Gov. Tim Walz, Attorney General Keith Ellison, Secretary of State Steve Simon and State Auditor Julie Blaha.

The state Teachers Retirement Association and Gov. Walz’s communications staff have not yet replied to requests for comment on Siedle’s article.

Siedle also claims the Teachers Retirement Association exec sent a similar email to Walz’s staff with an addendum: “We think it would be helpful and appropriate for Education Minnesota to publicly support TRA and the SBIs’ integrity. This effort poses a true reputational risk and will only distract from efforts to strengthen the TRA pension fund and member benefits.”

Siedle wrote that, “(a)sking Education Minnesota, an organization made up of 477 local unions and 84,000 members, including active and retired teachers, ‘to publicly support TRA and the SBIs’ integrity’ before a proposed investigation even began surely sounds desperate.”

The chain of emails were set off after Siedle was hired by a group of teachers in Minnesota to perform “a forensic audit, an in-depth, outside examination of an organization’s financial records and transactions to identify potential fraud, misconduct, or other irregularities.”

Similar pension fund investigation in Ohio in 2021 led to reform

While a similar independent investigation led by Siedle in 2021 in Ohio resulted in public calls for reform of that state’s own retirement system, a recent editorial by daily newspaper the Toledo Blade highlights the attention Siedle is now getting in Minnesota.

“A cursory look at the Minnesota Teachers Retirement Association leads to the conclusion they’re either a world class pension or they’re cooking the books,” the Toledo Blade editorial board wrote in a July 17 editorial.

“Minnesota reported investment fees on the $26.7 billion teacher pension fund of $24.1 million,” the editorial alleges. “The teachers fund has a $6.6 billion private equity portfolio that would be expected to pay at least $132 million a year to fund managers. Moreover, a comprehensive study of 54 public pensions from 2008 to 2023 conducted by investment expert Richard Ennis shows fees average 1 percent of assets under management. By that metric Minnesota Teachers Retirement Association would be expected to pay over a quarter billion dollars a year to fund managers.”

Siedle alleges the Minnesota media has been silent on this issue in recent weeks as it became widely known Walz was being considered among a group of finalists to serve as Kamala Harris’s presidential running mate.

“Gov. Walz is reportedly under consideration as a Democratic vice-presidential candidate yet he is almost completely unvetted by state media,” Siedle wrote. “Despite ‘red flags’ and questions whether someone is ‘cooking the books’ at the state’s massive pensions under Walz’s watch, only Ohio media has reported on the controversy. Minnesota media is mum.”

– – –

Hank Long is a journalism and communications professional whose writing career includes coverage of the Minnesota legislature, city and county governments and the commercial real estate industry. Hank received his undergraduate degree at the University of Minnesota, where he studied journalism, and his law degree at the University of St. Thomas.

Photo “Tim Walz” by Governor Tim Walz.