by Owen Klinksy

Americans looking to buy a home may have to wait as housing costs are expected to remain elevated until 2026 or later, according to a note from Bank of America (BofA) economists published Monday.

Homebuyers are facing elevated interest rates due to sky-high inflation under President Joe Biden and a housing shortage exacerbated by the COVID-19 pandemic that has led Americans to be hesitant to move, according to BofA. As a result, economists at the bank expect home prices to rise a total of 4.5% throughout the course of 2024 and another 5.0% throughout 2025, before easing slightly in 2026.

“The US housing market is stuck, and we are not convinced it will become unstuck anytime soon,” the Bank of America researchers wrote. “We view the forces that have reduced affordability, created a lock-in effect for homeowners, and limited housing activity will remain in place through our forecast horizon.”

Bank of America predicts a "prolonged lock-in effect" that'll "limit sales of existing homes"

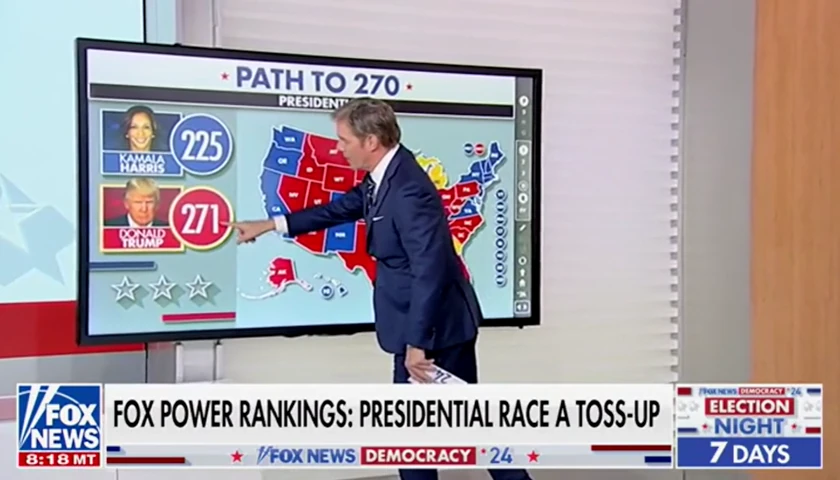

BofA's forecast for existing home sales:

Q3 '24: 4.087 million

Q4 '24: 4.052M

Q1 '25: 4.028M

Q2 '25: 4.030M

Q3 '25: 4.043M

Q4 '25: 4.069M

Q1 '26: 4.099M

Q2 '26: 4.128M

Q3 '26:… pic.twitter.com/ux8NmSwjiw— Lance Lambert (@NewsLambert) June 24, 2024

The Federal Reserve hiked its federal funds rate to a 23-year high range of 5.25% and 5.50%, which has helped cause the average rate for a 30-year fixed mortgage to rise from under 3% when Biden first took office to 6.86% as of Thursday, according to data from the Federal Reserve Bank of St. Louis. The rate was hiked due to high inflation, with prices increasing more than 20% since Biden took office in January 2021.

Bank of America’s bleak outlook on housing prices comes after the median price of a previously-owned U.S. home climbed in May for the 11th month in a row to a record of $419,300, up 6% from a year earlier, according to the National Association of Realtors.

High mortgage rates and prices have led economists to be pessimistic about the housing market due to the “lock-in effect,” a phenomenon of current homeowners refusing to list their homes which would give up the ultra-low mortgage rates they secured prior to the Fed’s recent actions, according to BofA.

“We think it could take 6 to 8 years for the lock-in effect (dearth of transactions in existing homes) to go away,” the BofA analysts wrote. “The wide gap between current mortgage rates and effective mortgage rates means most homeowners are unwilling to move unless forced.”

– – –

Owen Klinksy is a reporter at Daily Caller News Foundation.