U.S. Senator Bob Casey (D-PA) confirmed last Thursday that Democrats are still making decisions about tax cuts, including whether they will reverse the 2017 tax cuts championed by former President Donald Trump and other Republicans, including U.S. Senate nominee Dave McCormick.

Casey made the remarks to Roll Call after the publication noted that allowing the reduced tax rates established in the Tax Cuts and Jobs Act of 2017 to expire would violate President Joe Biden’s pledge not to increase taxes on those earning less than $400,000 per year.

While Biden promised he would not raise taxes on those earning less than $400,000 while campaigning in 2020, and renewed the promise in March 2022, the outlet described Casey as “noncommittal” on a tax hike.

“We’re going to have a lot of decisions to make about extending cuts or not,” said the Democrat. Casey told the outlet, “We haven’t made decisions about that yet.”

Casey was joined in his apparent willingness to raise taxes by Senator Elizabeth Warren (D-MA), who Roll Call explained argued it would be “[b]etter to let the Trump tax cuts expire than be accomplices to another slash-and-burn tax bonanza for America’s billionaires.”

McCormick responded on Tuesday by vowing not to support raising taxes on middle-income earners if Pennsylvanians elect him in November.

“At a time when the cost of gas, groceries, and rent is sky-high thanks to Democrats’ reckless spending, liberal, career politician Bob Casey is open to raising taxes on Pennsylvanians,” said the former Trump administration official. He added, “This is more proof that Casey will always put his friends in Washington over the people he serves.”

McCormick confirmed, “Bob Casey may not rule out raising taxes on middle-income Pennsylvanians, but I certainly do.”

Casey previously argued in April that Pennsylvanians should not trust McCormick on economics or taxes due to his wealth, claiming the Republican “is on the side of big corporations.”

Though Casey’s personal net worth is just over $660,000, his family members have reportedly benefited from his campaign, with The New York Post reporting last year that his political operation paid his sister’s printing company over $500,000 to make campaign materials over the course of Casey’s career.

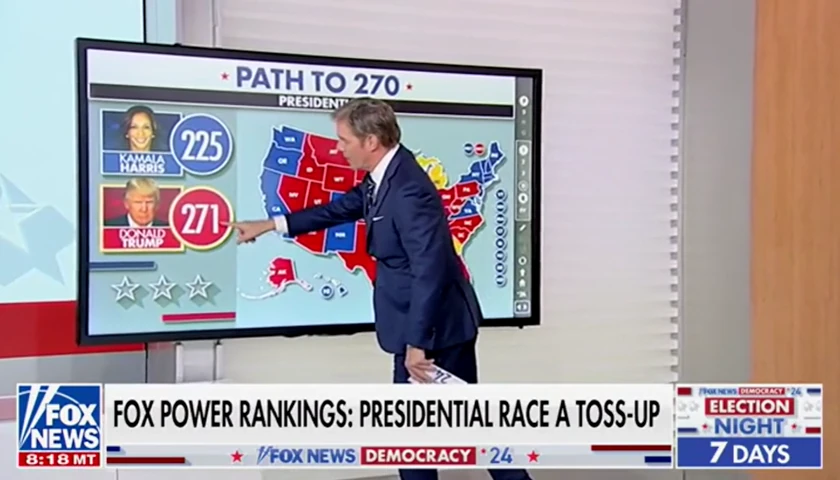

The tax cuts achieved under Trump have become an election-year issue, with proponents arguing that Biden would break a campaign promise if he allowed them to expire.

“This wouldn’t just break his pledge not to raise taxes on Americans earning less than $400,000, it would obliterate it. If Biden lets the Trump tax cuts expire, Americans earning less than $400,000 will be saddled with a tax hike of more than $2 trillion over 10 years,” said Heritage Foundation economist Preston Brashers in May.

He explained, “You can quibble about the precise size of the tax hike, but it’s undeniable that an expiration of the Trump tax cuts would hit the middle class.”

A 2021 analysis found Trump’s tax cuts benefited middle- and working-class Americans the most, while the Build Back Better Act that Biden signed into law that year was predicted to achieve the opposite, with middle- and working-class American hit the most.

– – –

Tom Pappert is the lead reporter for The Tennessee Star, and also reports for The Pennsylvania Daily Star and The Arizona Sun Times. Follow Tom on X/Twitter. Email tips to [email protected].