by Carly Moran

Estate planning could get a little easier in Michigan if a bill that cleared the Michigan House continues to move forward.

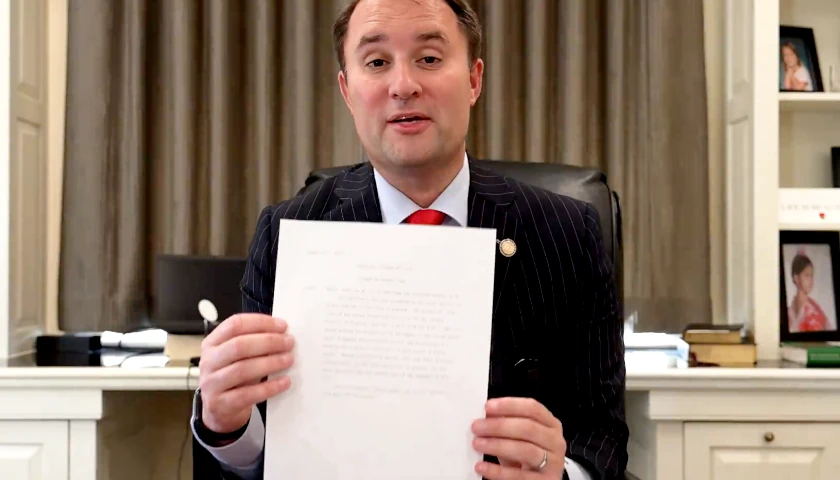

Sponsored by Rep. Doug Wozniak, R-Shelby Township, HB 5110 allows income trusts to convert to unitrusts, and vice versa. A unitrust gives a fixed percentage of the assets to the recipient per year, while an income trust provides a steady stream of income.

“It was great to see my colleagues from both sides of the aisle embrace my plan to open up the trust investment system,” Wozniak (pictured above) said. “This effort ensures that older Michigan trusts aren’t locked into outdated investment strategies and new trusts have the best available management options. My bill addresses the complexity of the trust management process by allowing estate planning attorneys and trustees to have additional trust management tools to tailor and manage assets.”

The bill was drafted with the help of the Probate and Estate Planning Section of the State Bar of Michigan. According to Wozniak, if the bill becomes law, it will allow for greater flexibility both in terms of investment options, and when working with estate planners.

– – –

Carly Moran is a contributor for The Center Square.

Photo “Doug Wozniak” by Doug Wozniak. Background Photo “Michigan Capitol” by Brian Charles Watson CC BY-SA 3.0.