by Andrew Powell

Critics say a bill that would increase retirement benefits for beneficiaries of the state’s defined-benefit pension system could put the system’s financials in future jeopardy.

House Bill 239, which passed favorably through the House Appropriations Committee meeting on Tuesday, will increase retirement benefits for the 629,073 members of the Florida Retirement System and 151,913 current retirees.

The bill would restore full retirement benefits to special risk employees, restore cost of living adjustments and lower the retirement age and years of service.

The FRS is the fourth largest state retirement system in the U.S. and is the primary retirement plan for employees of state and county government agencies, district school boards, state colleges and state universities.

First responders, including law enforcement, firefighters, correctional officers and emergency medical technicians will have the age of retirement lowered from 60 years of age to 55.

The minimum service time for first responders to receive full benefits will also be lowered from 30 years to 25 years.

The cost-of-living-adjustment was nixed for all years of service after July 1, 2011. The bill will restore the original 3% cost-of-living-adjustment, and this will not only be for retiring first responders, but also for teachers and other state employees.

Florida House Speaker Paul Renner, R-Palm Coast, said in a news release that thanks to Florida running an efficient government and the prudent investment of state dollars; the surplus that has been produced allows the state to better care for retirees.

“We value our workers and want to promote common sense incentives to recruit and retain talent across our workforce to keep Florida prosperous,” Renner said.

Zachary Christensen, a pension policy analyst at Reason Foundation and managing director of Reason Foundation’s Pension Integrity Project, which studies and aims to reform public pension systems, told The Center Square that undoing the legislation enacted in 2011 will add additional costs to an already struggling retirement system.

“The amendment to the proposed state budget rolls back valuable cost-saving reforms that the Florida legislature enacted in 2011,” Christensen said. “Facing significant growth in unexpected costs after the Great Recession, policymakers prudently reassessed the risks and benefits that the state would be able to afford.

“Now policymakers are suggesting that the state can afford to bring those costs back, despite the Florida Retirement System making little progress on its funding. FRS was 87% funded in 2011 and is now just 83% funded in its latest reporting.

Christensen said the proposed changes could have negative consequences if the market takes a downward turn.

“The pension reform rollback would add additional costs to the pension promises that the state hasn’t even fully funded to date, and this action could generate significant unexpected costs in the event of another market downturn,” Christensen said. “This is a mistake that several states made in the early 2000s, one which they are still paying for by way of expensive public pension debt today.”

To ensure the pension funds not only cover benefits for retirees, but also public employees paying into the system, Florida lawmakers need to focus on what they have already promised, according to Christensen.

“Florida policymakers should first focus on fully paying for the benefits they have already promised to workers and retirees before promising more and adding more costs,” Christensen said. “At a time of notable market uncertainty, it is unwise to expose taxpayers to the same level of benefits that generated unaffordable, runaway pension costs in 2008 and 2009.”

– – –

Andrew Powell is a contributor to The Center Square.

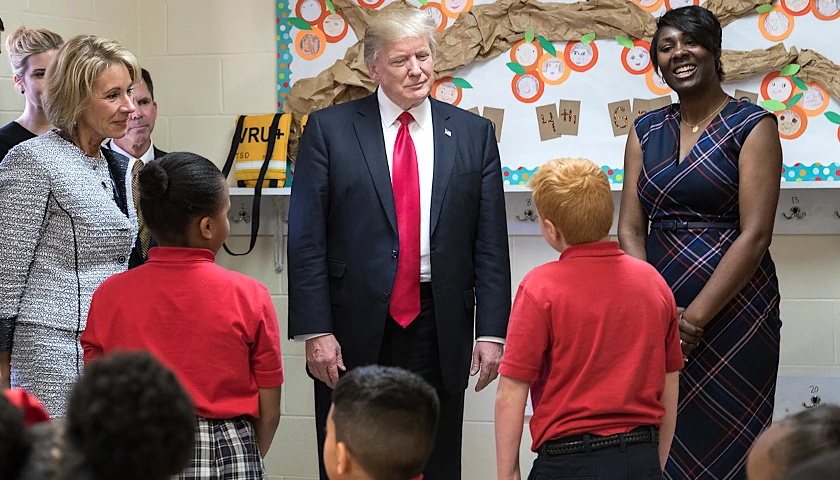

Photo “Paul Renner” by Florida House GOP.