In a bipartisan 8-3 vote on Tuesday, Pennsylvania’s Senate Finance Committee passed legislation to speed the state’s reduction of its corporate net income tax (CNIT).

Last year, as part of the Keystone State’s budget, lawmakers initiated a reduction of the CNIT from 9.99 percent to 4.99 percent over the next decade. Before the change, Pennsylvania had the second-highest state corporate tax in the U.S., behind New Jersey’s 11.5-percent rate.

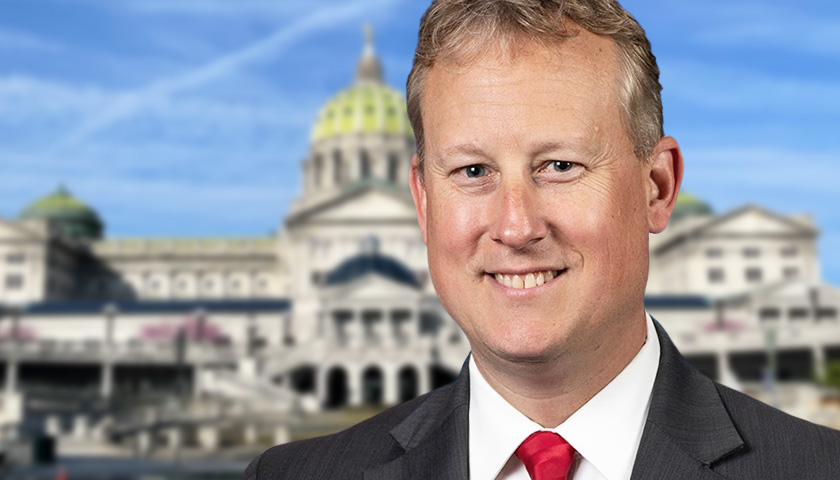

State Senator Ryan Aument’s (R-Lititz) (pictured above) bill would immediately drop the percentage to 7.99 and lower it by one point at the turn of each year until it reaches 4.99 in 2026, five years ahead of the decrease’s scheduled conclusion. In testimony before the committee, the senator made a twofold case for cutting the CNIT more quickly.

First, cutting the CNIT does not always mean forgoing money the state would get from it. The tax rate fell from 9.99 percent to 8.99 percent in January, but revenue collections in each month have since exceeded the CNIT revenues that came in one year before.

Second, many other states are reducing corporate taxes, with Arkansas, Iowa, New Hampshire, and Idaho enacting cuts last year. While Pennsylvania’s eventual 4.99-percent CNIT rate could be the ninth-lowest in the U.S. when achieved in 2031, but that eventuality is less likely as other states decrease their business taxes. Available data, he asserted, suggests CNIT reduction can increase Pennsylvania’s population, boost wages and increase home values.

“[Last year’s cut] was a historic step, but I think we have to recognize that other states that we are competing against… have taken advantage of the current economic climate to reduce their rates further…,” Aument said. “We are seeking to, in a sense, press down on the gas in terms of positioning this state to be economically competitive and ensure that each and every resident of this commonwealth has the opportunity to experience earned success and economic upward mobility here in Pennsylvania.”

State Senator Greg Rothman (R-New Bloomfield), Aument’s principal cosponsor, echoed his colleague’s emphasis on competitiveness, suggesting that the commonwealth’s inability to keep working people in-state amounts to a “demographic crisis.” He cited Independent Fiscal Office data suggesting that Pennsylvania will lose 0.5 percent of its working-age population between 2020 and 2025 while the rest of the nation gains 7.5 percent. By 2030, Pennsylvania’s total population growth is projected to be 0 percent.

Rothman also mentioned survey results from the Harrisburg-based Commonwealth Foundation showing 44 percent of Pennsylvanians have either considered leaving the state or know someone else who has. Most respondents said the state’s high cost of living was a major reason why. Many others said they wanted better career opportunities or lower taxes.

“I’m concerned that we’re losing our businesses,” Rothman said. “This [legislation] is… an opportunity to retain the job creators in Pennsylvania.”

In his budget address in March, Governor Josh Shapiro (D) said he would back an accelerated CNIT decrease. Support for that policy got enthusiastic support from another Democrat, Senate Finance Committee Minority Chair Nick Miller (D-Allentown), during Tuesday’s voting meeting.

“Knowing that this will be part of the budget negotiations, I think this is incredible for our economic competitiveness,” he said.

Still, several Senate Finance Committee Democrats objected to the Aument bill.

“[I’m] concerned about the speed of the change,” Senator Art Haywood (D-Philadelphia) said. “We just adopted the reductions over a 10-year period, so I’m very concerned about the impact on recurring revenue. We’ve had a number of conversations about when our revenue situation may significantly deteriorate in the commonwealth and [I] certainly don’t want to make that deterioration any worse by having a significant reduction in revenue that we’re still figuring out.”

State Senator Katie Muth (D-Royersford) also voted against the CNIT-cut acceleration, as did State Senator Wayne Fontana (D-Pittsburgh), though the latter explained he would like to see a similar policy introduced as part of the Fiscal Year 2023-24 budget. He said he may or may not vote for the Aument legislation when it reaches the Senate floor.

– – –

Bradley Vasoli is managing editor of The Pennsylvania Daily Star. Follow Brad on Twitter at @BVasoli. Email tips to [email protected].