by Robert Romano

The unemployment rate still remains at historic lows of 3.4 percent in April, according to the latest data by the Bureau of Labor Statistics, amid other worrying signs for the U.S. economy including a continued collapse of job openings, a string of bank failure and an overall slowing Gross Domestic Product (GDP).

In the survey, as the population increased by 171,000, those not in the labor force increased by 214,000 as labor participation dipped slightly by 43,000. Those who said they had a job increased by 139,000 after a 577,000 increase in March. As a result, the unemployment rate has actually ticked downward for two consecutive months from 3.6 percent in February, to 3.5 percent in March and now 3.4 percent in April.

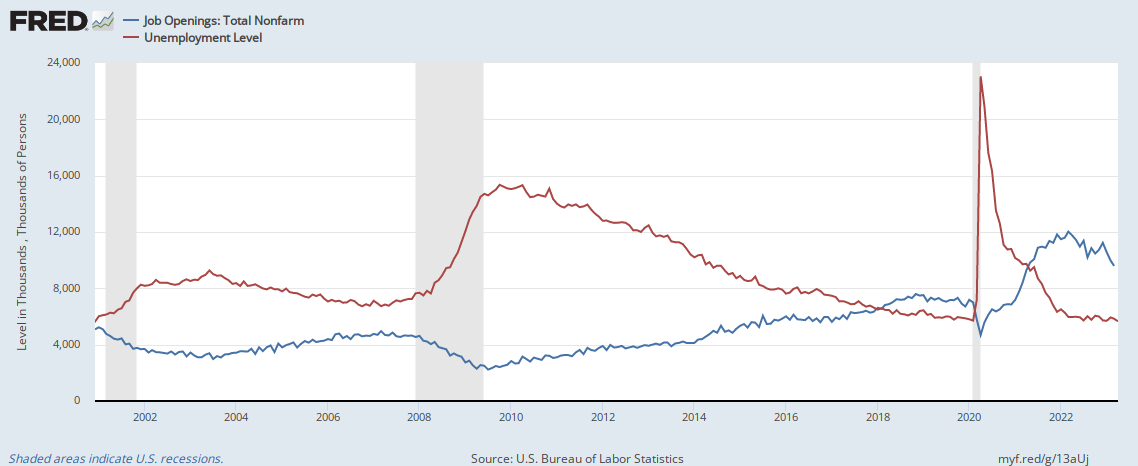

Still, other data continues to show growing weakness in the overall economy, as job openings continued a months long collapse, from 12 million in March 2022 to 9.6 million in March 2023. Usually prior to a recession, job openings will peak, followed by an upward trend of unemployment.

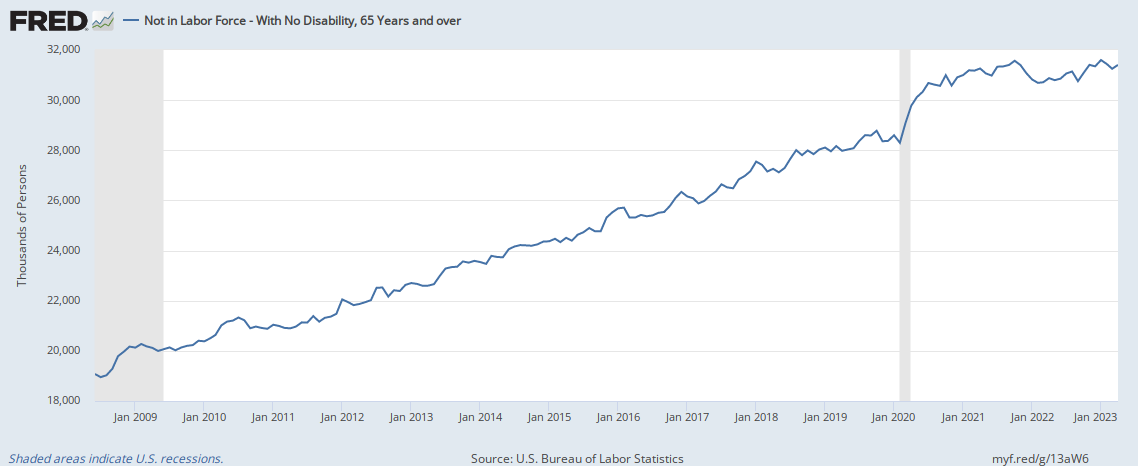

And yet, the sheer magnitude of job openings remains something of a puzzle for economists and financial pundits, after skyrocketing after the Covid pandemic. But a key metric to consider are retiring Baby Boomers: the number Americans not in the labor force 65 years old and older has increased 3.27 million since Feb. 2020, from 28.3 million to 31.4 million today.

This is a situation akin to Japan, which similarly has experienced demographic decline the past few decades with a rapidly aging population following very low fertility rates. During the financial crisis and Great Recession of 2008 and 2009, the unemployment rate only reached 5.7 percent (here it reached 10 percent in Oct. 2009), and just 3.2 percent during the Covid recession.

Meaning, labor shortages can have a discernable impact on how recessions are felt, and may be one of the factors to consider moving forward as other signs may yet be pointing to a downturn on the horizon.

The U.S. Gross Domestic Product (GDP) grew at a less than expected 1.1 percent annualized in the first quarter of 2023, according to the latest data from the Bureau of Economic Analysis, down from 3.2 percent in the third quarter of 2022 and 2.6 percent in the fourth quarter in 2022.

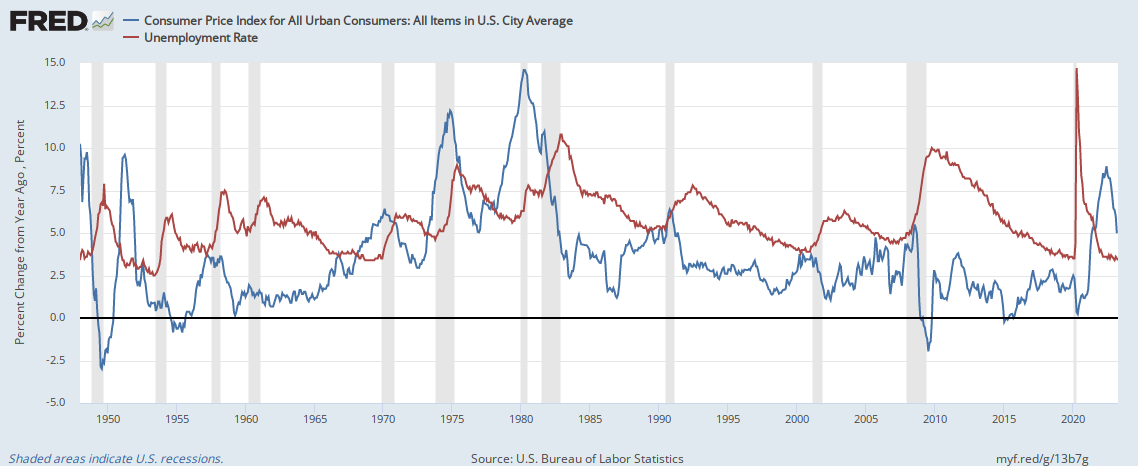

There is also inflation, which peaked at 9.1 percent in June 2022 and was down to 5 percent in March. Usually peak inflation followed by a slowdown in the increase in prices also precedes a downturn.

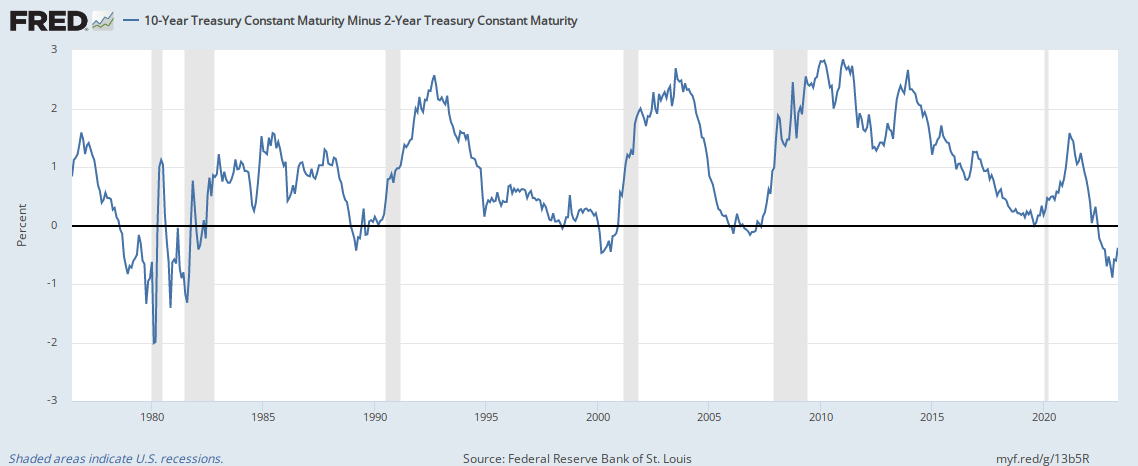

Another key predictor has historically been the spread between 10-year treasuries and 2-year treasuries, an inversion of which usually predicts a recession on the horizon as long term growth is perceived to be lower than short term growth. The 10-year, 2-year inverted briefly in March 2022 and then succumbed fully in July 2022, where it has remained. Usually, as a recession comes, this spread will uninvert itself, which may be starting to happen, as it has gone from -1.03 percent in March to now just -0.38 percent. It hasn’t uninverted yet, though, something to keep in mind.

And then there is the string of regional bank failures to date: First Republic Bank, Silicon Valley Bank and Signature Bank all were placed into FDIC receivership in the past month or so—the second, third and fourth largest bank failures in American history—with more perhaps on the way.

Shares of PacWest have collapsed nearly 90 percent since February, Western Alliance Bancgroup by 77 percent and Zions Bancorpation by 63 percent. Overall, the SPDR S&P Regional Banking ETF is down 44 percent since February. Similar drops in the stock values of First Republic, Silicon Valley and Signature banks signaled their ends too, and could point to more financial stress on the horizon.

All of those factors still appear to point to a recession dead ahead, as the White House Office of Management and Budget and the Federal Reserve still project the unemployment rate to rise to 4.6 percent in 2024, an implied 2 million or so job losses between now and then. To the extent that might be tempered appears to be by the continued labor shortages as the Baby Boomer retirement continues. Something’s got to give. Stay tuned.

– – –

Robert Romano is the Vice President of Public Policy at Americans for Limited Government Foundation.

Photo “Alliance Bank” by Cygnusloop99. CC BY-SA 3.0.