Tennessee Congressman John Rose (R-TN-06) recently introduced a bill in the U.S. House of Representatives that would “stop the government from warrantless surveillance of the American people,” according to a press release by Rose’s office.

H.R.9159, or the Bank Privacy Reform Act, would “reform the Bank Secrecy Act of 1970 by repealing requirements for financial institutions to report customers’ financial information, including transaction history, to government agencies without a warrant,” according to Rose.

As the first piece of federal legislation to stop money laundering, the Bank Secrecy Act was enacted in 1970 by Congress, according to the Internal Revenue Service (IRS).

As part of the Bank Secrecy Act, businesses must keep records and files that can be useful in criminal, tax, and regulatory matters. In addition to identifying, detecting, and deterring money laundering, law enforcement agencies both domestically and internationally heavily use the documents businesses file under BSA requirements. These documents can be used for criminal enterprise, terrorism, tax evasion, and other illegal activity, the IRS notes.

Rose’s legislation retains sections of the Bank Secrecy Act that mandate financial institutions maintain customer records, but repeals those that require them to report without probable cause to government agencies.

“Currently, the Bank Secrecy Act deputizes banks and allows for the warrantless surveillance of the American people,” Congressman Rose said in a statement. “The right to privacy is one of the hallmarks of a free country. The Fourth Amendment protects people from unreasonable searches and seizures. My bill, the Bank Privacy Reform Act, reaffirms those protections and would prevent the government from spying on consumers’ transaction history without first obtaining a warrant.”

Congressman Rose cited two data sources in his press release supporting his bill.

First, he cited FDIC surveys that reported an estimated one-third of the unbanked remain outside the banking system due to their unwillingness to disclose their financial information.

Congressman Rose also cited a national survey by the CATO Institute which reported that “79 percent of respondents said it’s unreasonable for banks to share personal records and bank transactions with the federal government, while 83 percent said the government should obtain a warrant to access your financial records.”

– – –

Kaitlin Housler is a reporter at The Tennessee Star and The Star News Network.

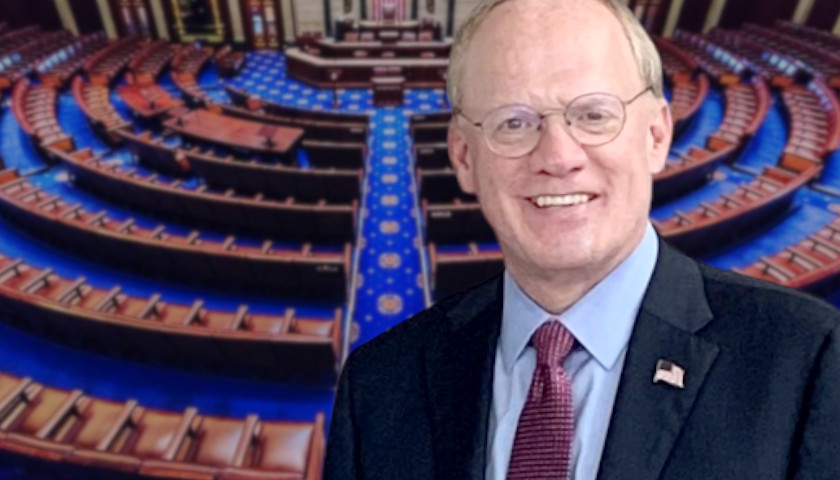

Photo “John Rose” by John Rose.