by Scott McClallen

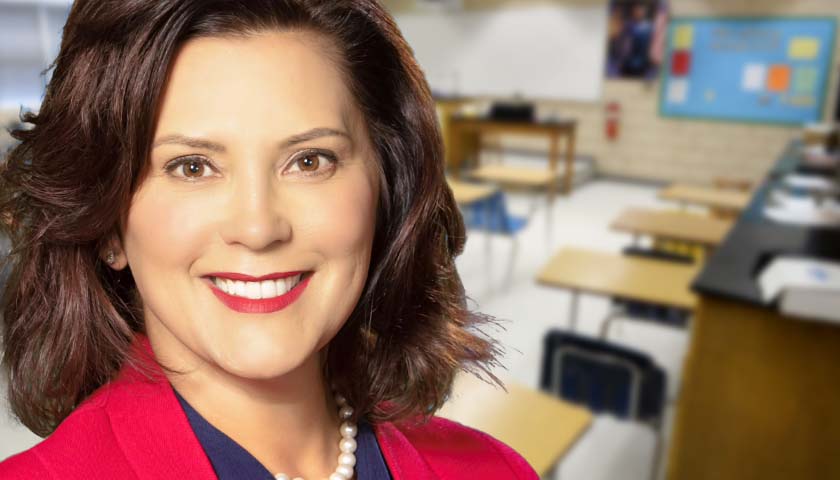

Gov. Gretchen Whitmer proposed suspending the Michigan sales tax on school supplies for the upcoming school year, drawing GOP criticism of “pandering.”

“As families gear up for the school year, they should be able to get what they need without spending too much money out of pocket,” Whitmer said in a statement. “That’s why I’m putting forward the MI Back to School Plan, which includes a proposal to temporarily suspend the sales tax on school supplies. Getting this done would lower costs for parents, teachers, and students right now, and ensure that they have the resources to succeed.”

A recent Deloitte report estimated parents expect to spend $661 per child on school supplies this year, up about $49 more than last year’s estimate of $612.

Senate Majority Leader Mike Shirkey, R-Clarklake, said that Whitmer’s offer right before school starts is “nothing but shameless pandering.”

“If press releases were leadership, Michigan might have an effective governor,” Shirkey said in a statement. “But they’re not, and we don’t. The people of this state are smarter than Gov. Whitmer gives them credit for. They know she’s done absolutely nothing to help them through these historically difficult times, and that today’s announcement on the eve of school starting is nothing but shameless pandering.”

The clash follows a $77 billion budget for fiscal year 2023 that included $1 billion for lawmaker pet projects but no tax relief, despite $7 billion remaining unspent in the state’s coffers. The state plans to spend more than $19 billion on education in 2023.

The federal government is giving Michigan schools and higher education institutes $7.92 billion of COVID relief money, of which they’ve only spent $3.92 billion, or 44%. The last spending deadline is in 2024.

Still, Stephanie Klein, Great Start Readiness Program Director and lead co-teacher in the Menominee County Intermediate School District, called for additional taxpayer support.

“With the continued rising cost of just about everything needed to supply a classroom; teachers like myself are having to resort to creating wishlists on Amazon and sharing them on social media like Tik Tok, Instagram, Facebook and Twitter, in the hopes that some companies will help “#CLEARTHELIST,” Klein said in a statement.

“A “teacher tax holiday” would help take a little pressure off the pocketbooks of so many educators. School districts can only provide so much money for budgeted supplies and the extras are usually put on the back burner to wait and see if there is extra money left over. Usually, teachers end up funding the extras themselves, but I would rather that than have my students not flourish!”

Louis Zemlick, president and owner of Zemlick’s office supplies store in Kalamazoo, estimates an average family would save around $54 per child if lawmakers and Whitmer enacted the sales tax holiday.

Shirkey called for permanent tax relief, a GOP effort that Whitmer vetoed.

“Months ago, Gov. Whitmer vetoed our bipartisan plan to lower taxes for a family of four by at least $1,300,” Shirkey said. “Now, she’s offering a plan that might save them $54. That’s not help — it’s a slap in the face. The people of our state need real, permanent tax relief. Their governor isn’t just a day late and a dollar short, she’s months late and billions of dollars short.”

– – –

Scott McClallen is a staff writer covering Michigan and Minnesota for The Center Square. A graduate of Hillsdale College, his work has appeared on Forbes.com and FEE.org. Previously, he worked as a financial analyst at Pepsi.

Photo “Gretchen Whitmer” by Office of the Governor, State of Michigan. CC BY-SA 3.0. Background Photo “Classroom” by Steevven1. CC BY 4.0.