by

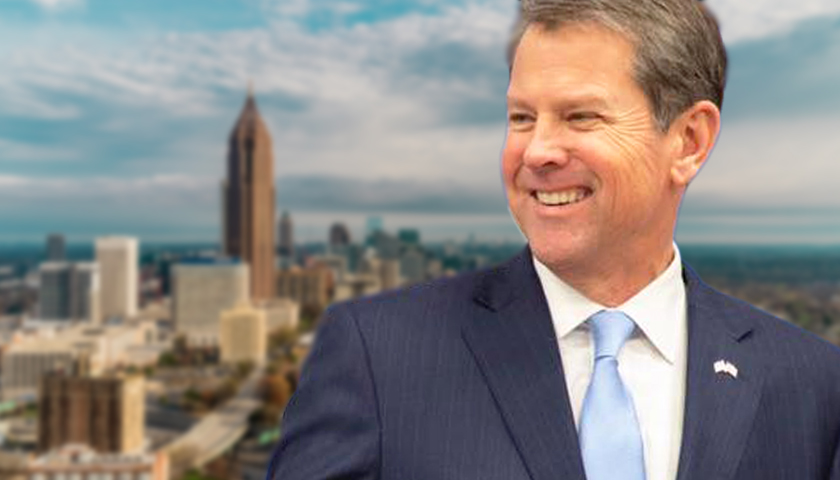

Georgia Gov. Brian Kemp signed a measure Wednesday to give a one-time tax refund to eligible Georgia taxpayers.

Taxpayers who are single or married and filing separately will receive a $250 refund under House Bill 1302. Heads of households will receive a $375 refund, while married taxpayers who file jointly will receive a $500 refund.

The Georgia Department of Revenue will credit taxpayers with the refund once they file their 2021 taxes, which are due April 18. Taxpayers who already have filed their 2021 taxes will receive a refund based on what they indicated on their tax returns.

“When government takes in more than it needs, I believe those dollars should be returned to the taxpayer, because that is your money – not the government’s,” Kemp said in a statement. “In Georgia, we are taking swift action to lessen the impact of the federal administration’s disastrous policies that have driven record-high inflation over the last year by putting taxpayer dollars back in the pockets of hardworking Georgians.”

To be eligible for a refund, taxpayers must have filed returns for 2020 and 2021. In a news release, Speaker of the House David Ralston, R-Blue Ridge, said the state is “returning more than a billion dollars to Georgia taxpayers.”

The refund follows another break for Georgians – a reduction of gas taxes in the state. Kemp signed House Bill 304 last week to temporarily suspend the state’s tax on motor fuel sales through May 31.

“This is going to bring immediate financial relief to small businesses already struggling with soaring inflation, supply chain disruptions, and labor challenges,” National Federation of Independent Business (NFIB) State Director Nathan Humphrey said in a statement last week. “… Our members realize this isn’t a permanent solution and addresses only one of the factors affecting costs, but it’s going to make a big difference.”

– – –