by Scott McClallen

Michigan has collected about $271 million in legal, adult-use marijuana tax revenue since 2019, according to a new report from the Marijuana Policy Project that analyzed tax revenue in states with adult-use cannabis since 2014.

In March 2021, the Michigan Treasury described what adult-use cannabis taxes collected in fiscal year 2020 will fund:

“[a]side from the nearly $10 million in disbursements to municipalities and counties, around $11.6 million will be sent to the School Aid Fund for K-12 education and another $11.6 million to the Michigan Transportation Fund, upon appropriation. The remaining $12.5 million amount will be used toward start-up and administrative costs.”

Eighteen states have laws that legalize, tax, and regulate cannabis for adults 21 and older. A 2020 voter-approved adult-use legalization law in South Dakota was overturned by the state’s Supreme Court in November 2021.

Eight of the laws were approved in 2020 or 2021, and in seven of those states, sales and tax collections have either not yet begun (or began within the last week).

These figures don’t include medical cannabis tax revenue, application and licensing fees paid by cannabis businesses, additional income taxes generated by workers in the cannabis industry, or corporate taxes paid to the federal government.

As of December 2021, states with legal marijuana reported a collective $10.4 billion in tax revenue from legal, adult-use cannabis sales, with more than $3 billion reported in 2021 so far. States haven’t yet reported revenue for the final three months of 2021.

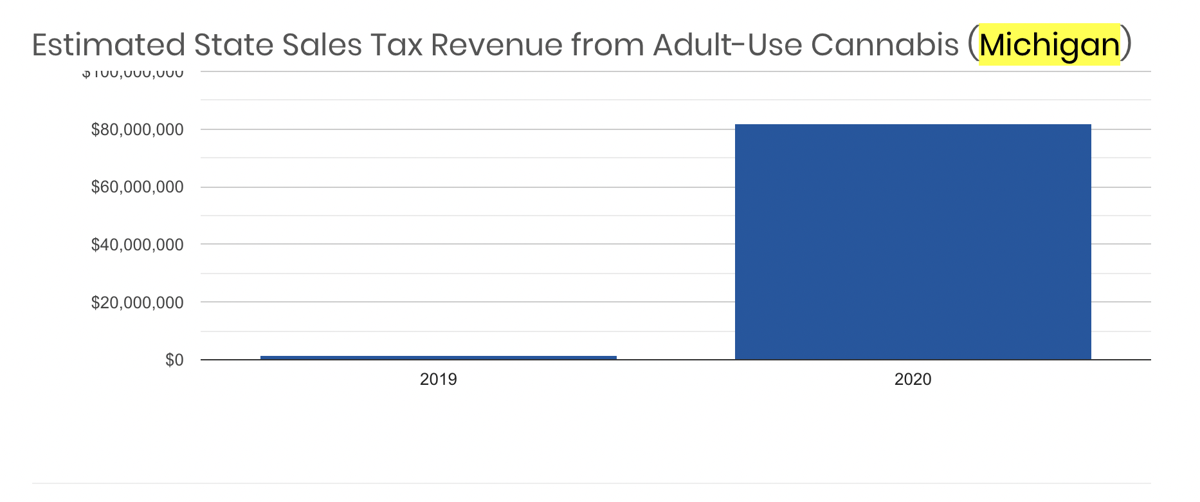

A comparison of the amount of legal, adult-use marijuana purchased in 2019 compared to 2020. (Courtesy of the Marijuana Policy Project)

The report includes the tax structure for each state, total revenue generated each year, and additional information about how the revenue is being distributed to public services and programs.

Michigan voters approved an initiative to legalize and regulate cannabis for adult use in November 2018. Sales started slowly in 2019 but in 2020, sales skyrocketed.

In states with legal, adult-use cannabis sales, tax revenues can be allocated for social services and programs. This includes funding education, school construction, early literacy programs, public libraries, bullying prevention, behavioral health, alcohol and drug treatment, veterans’ services, conservation, job training, conviction expungement expenses, and reinvestment in communities that have been disproportionately affected by the war on cannabis, among many others.

– – –

Scott McClallen is a staff writer covering Michigan and Minnesota for The Center Square. A graduate of Hillsdale College, his work has appeared on Forbes.com and FEE.org. Previously, he worked as a financial analyst at Pepsi.

Photo “Marijuana Farm” by Lindsay Fox CC BY 2.0.