The vast majority of Ohio’s 11 GOP congressional delegates have signed on as co-sponsors of a House resolution opposing a proposal granting the Internal Revenue expanded power to reach into the private financial transaction records of Americans’ financial accounts.

The wall of support for House Resolution 5586, filed October 15 by U.S. Representative Drew Ferguson IV (R-GA-03) comes even as the Biden administration modified an earlier policy proposal that critics have said would have covered nearly anyone with a financial account as it seeks to catch taxpayers underreporting income.

The original proposal from the Biden administration had called for banks, credit unions and other financial institutions to report activity from accounts with those with at $600 in annual transactions. That threshold has now risen to $10,000 but does not count automatic deposits.

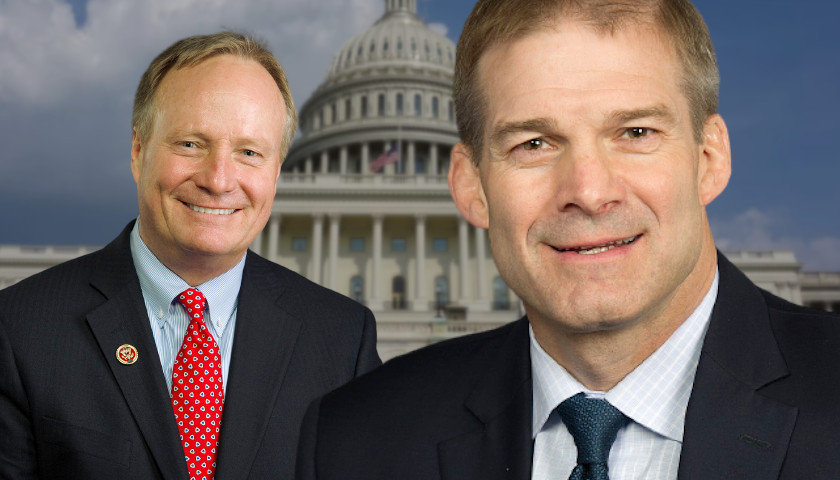

U.S. Representative Dave Joyce (R-OH-14) joined the list of nine HR 5586 supporters from Ohio last week because of what he contends is government overreach.

“I’ve heard from countless constituents who are outraged about the Biden Administration’s attempt to subject them and their families to unjustified IRS surveillance, and rightfully so,” Joyce said in the news release. “The federal government should not have unfettered access to millions of Americans’ financial transactions, nor can it be trusted to keep that information secure at a time when our country is increasingly susceptible to cyberattacks.”

Rep. Jim Jordan (R-OH-04) is the only GOP congressman from Ohio who has not signed on as a co-sponsor.

The one-page Prohibiting IRS Financial Surveillance Act only supported by 171 GOP members of Congress reads, in its substance:

“The Secretary of the Treasury (including any delegate of the Secretary) may not require any financial institution to report the inflows or out-flows (or any similar amount, whether on a transaction or aggregate basis) of any account maintained by such institution, except to the extent that such reporting is required under any program, or other provision of law, as in effect on October 1, 2021.”

Ohio Attorney General David Yost in mid-October had joined with 19 other state attorneys general in lambasting the $600 transaction level as an unconstitutional breach of individual financials privacy expectations that also would create a burdensome expense on banks and other institutions.

U.S. Senator Rob Portman, R-OH, on Monday had taken to the Senate floor to discuss the IRS financial reporting proposal in remarks that also covered the status of the broad Build Back Better spending and social policy legislation which he opposes and the $1 trillion infrastructure which he has championed.

On the issue of granting the IRS expanded reporting authority, Portman said the policy would discourage Americans from using regulated financial institutions while overwhelming the IRS with information it could sift through, even at the higher annual $10,000 threshold, or $830 per month.

“Now that higher threshold is something that most Americans would reach pretty quickly,” Portman said in his remarks. “Do you spend $830 a month on groceries, gas, clothes, essentials? If you do, then be prepared for the IRS to look through your tax records in ways they never have before.”

That said, the office of U.S. Senator Sherrod Brown called the uproar much ado about something less than feared.

A statement from his offices pointed to a Washington Post story debunking Republicans’ understanding of the proposal, which the Biden administration contends is designed to recoup a portion of an estimated $600 billion in unpaid taxes annually, including $160 billion from the top 1 percent of American taxpayers.

“The IRS will not have the authority to look at everyday families’ bank accounts, period,” Brown said in a statement sent in response to The Ohio Star.” To say otherwise is a partisan lie, which has been fact-checked and proven false. We need more tools to crack down on wealthy tax cheats.”

The WaPo article, also supported by reports in Forbes and a Treasury fact sheet, says the administration wants more agents and expand reporting of transactions not already subject to reporting as is done automatically with wages and investment income.

“That’s who this is about: the CEOs who try to hide their millions,” Brown said in the statement, “and the lobbying firms that help them evade the law.”

– – –

Brian R. Ball is a veteran journalist in Columbus writing for The Ohio Star and the Star News Network. Send news tips for him at [email protected].